Top Insights into Iranian Energy Drink Consumers and Market

What’s Powering Iran’s Energy Drink Trend?

According to a recent field study conducted by Myindustry Consulting Group (MCG) in the first half of 2025, Iran’s energy drink market is undergoing a dynamic transformation. With an expanding youth population, increased urbanization, and growing interest in fitness and mental performance, the consumption of energy drinks is rising steadily. This article presents an in-depth analysis of consumer behavior, demographic trends, brand competition, and retail dynamics shaping the Iranian energy drink market. (Also read “drink industry in Iran” & “Beverage Prices in Iran“)

Market Size of Energy Drinks in Iran

According to Data Bridge Market Research, the energy drink market in Iran was valued at USD 46.02 billion in 2024 and is projected to reach USD 90.01 billion by 2032, with an estimated compound annual growth rate (CAGR) of 6.3%. However, this valuation appears highly inflated when juxtaposed with the size of Iran’s economy, where the national GDP hovers around USD 500 billion. If taken at face value, it would imply that energy drinks account for nearly 10–18% of the country’s entire economic output—an unrealistic scenario by any industrial or macroeconomic standard.

In contrast, Myindustry Consulting Group (MCG) provides a grounded, data-driven estimate based on actual consumption and pricing trends in 2025. According to MCG’s field research, approximately 160 million units of 250 ml cans and 30 million units of 500 ml cans are sold annually in Iran. With an average retail price of $0.33 per 250 ml can and $0.80 per 500 ml can, the total annual market value is calculated as follows:

-

160 million × $0.33 = $52.8 million

-

30 million × $0.80 = $24.0 million

-

Total Estimated Market Value = $76.8 million per year

This more realistic valuation reflects actual consumer behavior, average purchase power, and distribution capacity in Iran’s beverage market. While the sector is experiencing steady growth fueled by urban youth and lifestyle shifts, it remains a fast-moving consumer niche rather than a dominant economic force.

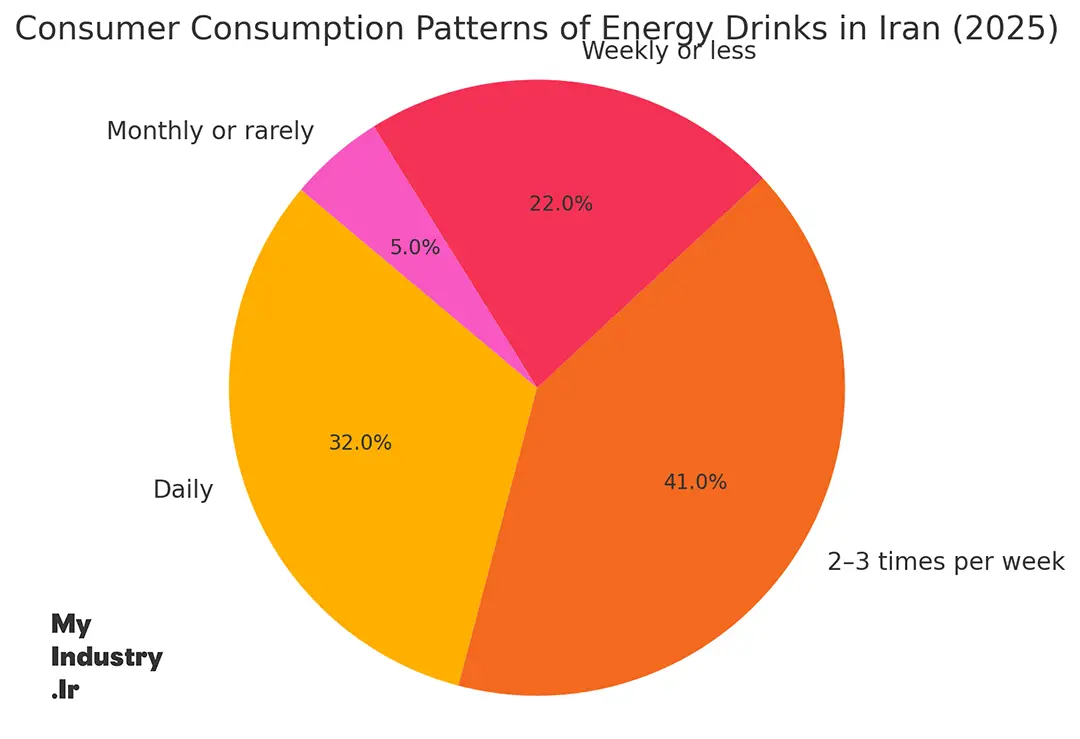

Consumer Consumption Patterns

The study categorized consumers based on their frequency of consumption, revealing the following distribution:

| Frequency of Consumption | Percentage of Consumers |

|---|---|

| Daily | 32% |

| 2–3 times per week | 41% |

| Weekly or less | 22% |

| Monthly or rarely | 5% |

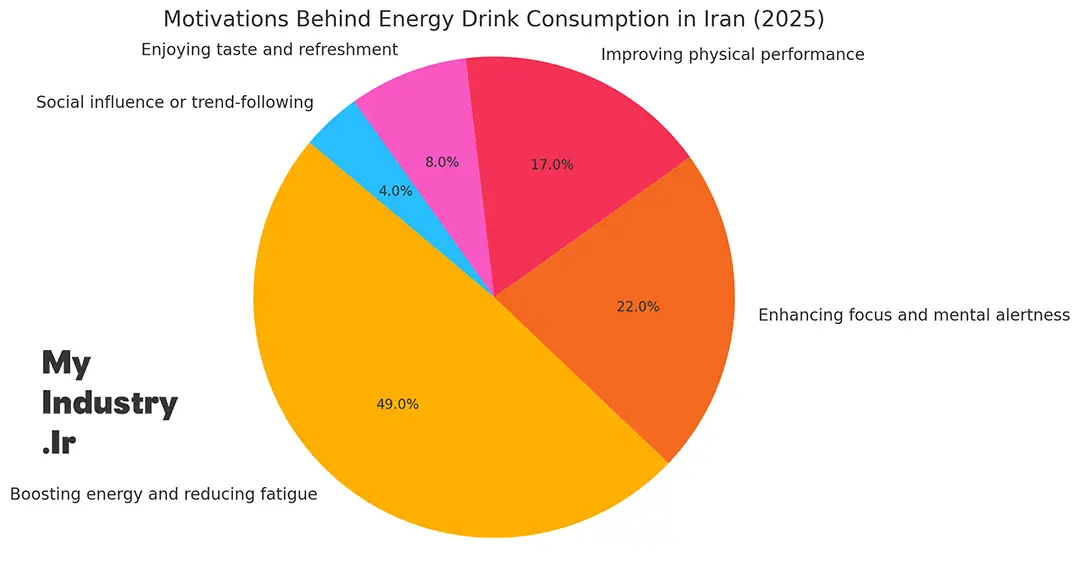

Motivations Behind Consumption

The core drivers of energy drink consumption in Iran include:

| Motivation | Share of Consumers |

|---|---|

| Boosting energy and reducing fatigue | 49% |

| Enhancing focus and mental alertness | 22% |

| Improving physical performance | 17% |

| Enjoying taste and refreshment | 8% |

| Social influence or trend-following | 4% |

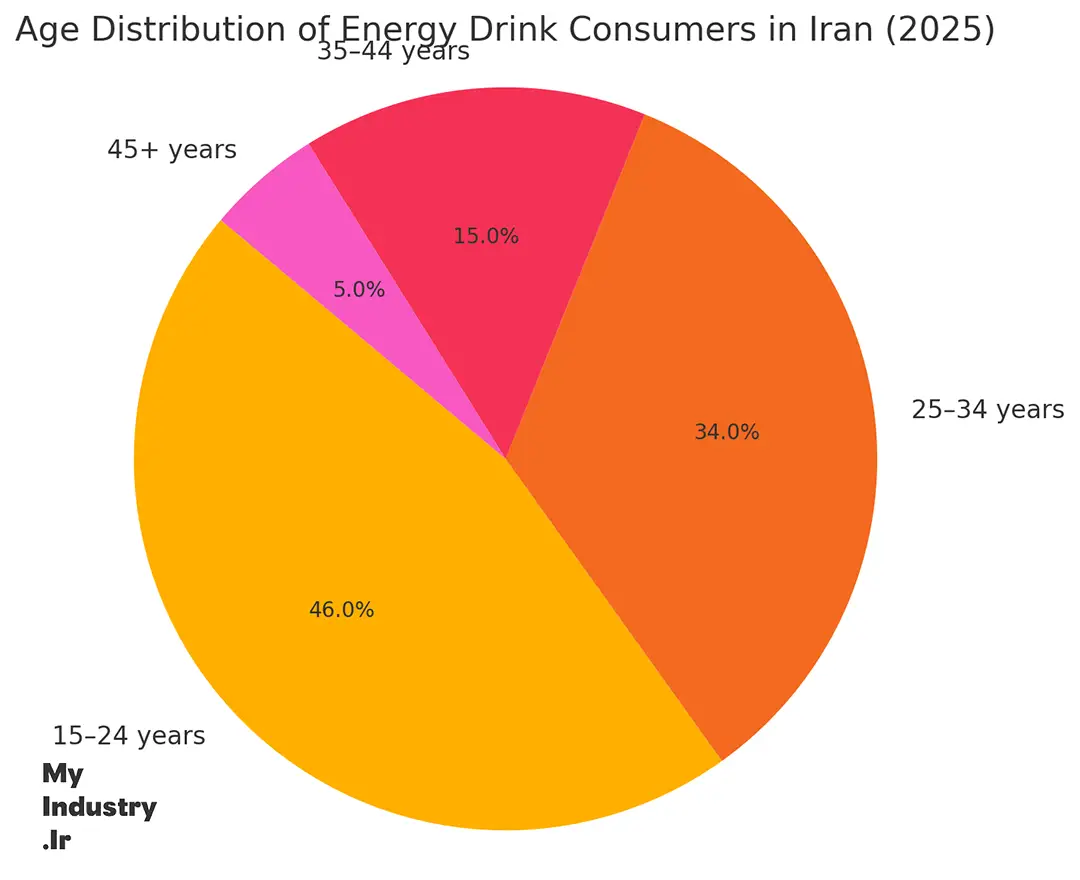

Demographics and Gender Distribution

| Age Group | Share of Consumers |

|---|---|

| 15–24 years | 46% |

| 25–34 years | 34% |

| 35–44 years | 15% |

| 45+ years | 5% |

| Gender | Share of Consumers |

|---|---|

| Male | 68% |

| Female | 32% |

The market is clearly youth-driven, with the majority of consumers under the age of 35. Although energy drinks were once a male-dominated product category, female participation is increasing, especially among fitness-oriented urban women.

Brand Landscape and Market Share

The study identifies several leading players in the Iranian energy drink market:

1. Hype

Once a global brand, Hype now dominates Iran’s market with local production. With a long-standing presence and strong distribution network, it retains an estimated 30–35% market share.

2. Big Bear

Produced by Morvarid Pargas, Big Bear is known for its high quality and aggressive placement in gyms and youth markets. Its popularity is rising rapidly, supported by a modern image and competitive pricing.

3. Edge (by Sunich)

Owned by the well-established Iranian beverage company Sunich, Edge benefits from an extensive distribution network, strong brand reputation, and nationwide reach.

Sunich, the parent company of Edge, is one of Iran’s largest and most reputable food and beverage manufacturers. With decades of experience in producing fruit juices, syrups, carbonated drinks, and concentrates, Sunich has built a powerful brand presence across the country. Its extensive production capacity, advanced bottling facilities, and robust nationwide distribution network have enabled it to successfully diversify into the energy drink segment with Edge, quickly gaining visibility and shelf space in both traditional and modern retail outlets.

4. Happy Life

Known for trendy packaging and youth-centric branding, Happy Life is gaining traction, particularly in retail chains and among university students.

5. Life Star

A well-recognized brand that recently won a “Consumer Choice Award,” Life Star is popular due to its affordability and widespread availability in convenience stores.

6. Red Bull and Other Imports

Due to sanctions, high import costs, and limited availability, Red Bull and other global brands hold less than 10% of the Iranian market, mostly appealing to niche or luxury consumers.

| Brand Segment | Approximate Share |

|---|---|

| Hype | ~30–35% |

| Big Bear, Edge, Happy Life, Life Star | ~25–30% combined |

| International Brands (Red Bull, etc.) | <10% |

| Others (low-penetration local labels) | ~30% |

Competitive Positioning of Leading Energy Drink Brands in Iran

Each of Iran’s major energy drink brands has carved out a distinct market position, relying on a unique set of strengths in branding, distribution, pricing, or consumer targeting. Below is a comparative analysis of the competitive edge that defines the performance of each leading brand in the Iranian market:

-

Hype maintains its leadership through first-mover advantage, long-standing brand recognition, and a well-established distribution network across urban and rural retail points. Its ability to sustain visibility despite increasing competition highlights its entrenched market presence.

-

Big Bear appeals strongly to fitness-oriented consumers and younger males, thanks to its sporty branding and strong association with gyms and supplement shops. With an image positioned between performance and affordability, it benefits from growing interest in physical wellness and energy optimization.

-

Edge, as part of Sunich, leverages the parent company’s vast retail infrastructure, especially in modern trade and supermarket chains. This access, combined with reliable quality standards and local pricing, enables Edge to scale quickly across Iran’s mass market.

-

Happy Life targets younger consumers through trendy packaging and lifestyle-based marketing, especially in social media and youth-centric retail spaces. It performs well in convenience stores and university zones.

-

Life Star focuses on price-sensitive consumers, offering affordable energy drinks with wide accessibility. Its strength lies in nationwide availability and brand trust among budget-conscious segments.

-

Red Bull and other imports, while prestigious, are constrained by high price points, limited availability, and import restrictions. They retain niche appeal among affluent consumers and trend followers but are unlikely to expand significantly under current economic conditions.

This competitive landscape reveals that domestic brands are not only dominant in terms of volume but are also increasingly sophisticated in their segmentation strategies, catering to diverse consumer needs through pricing, packaging, and distribution advantages.

Pricing Overview of Energy Drinks in Iran

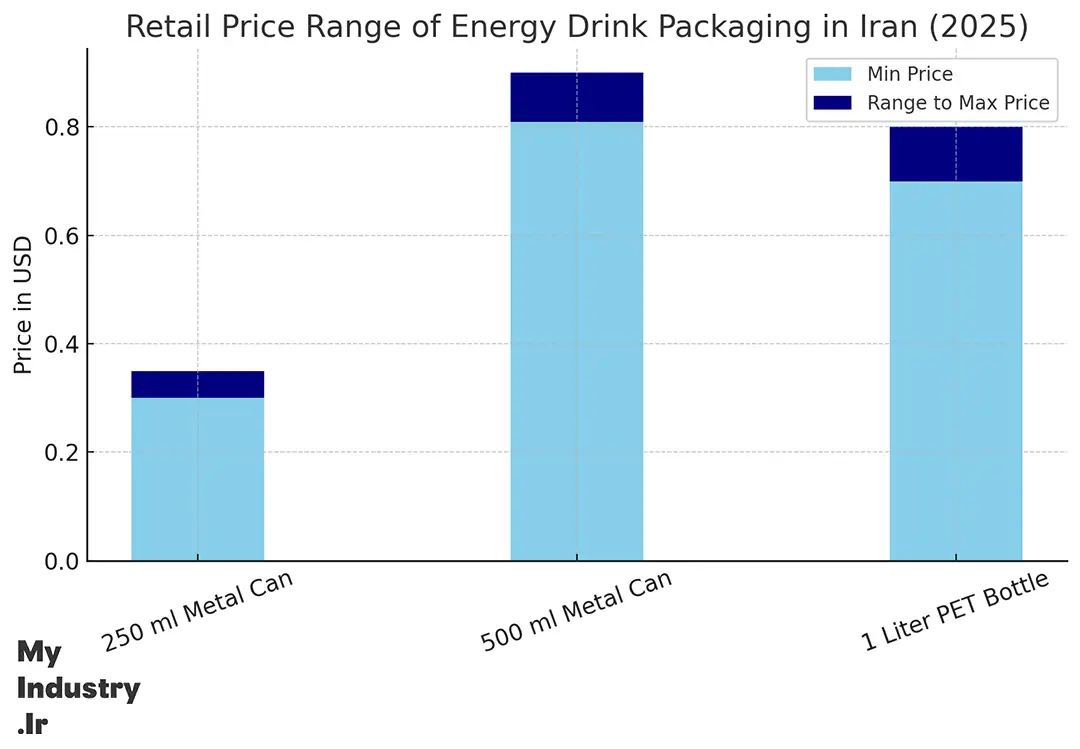

The Iranian energy drink market offers a variety of packaging formats that cater to different consumer segments and price sensitivities. As of 2025, the average retail price of a 250 ml metal can ranges between $0.30 and $0.35, making it the most popular and accessible option for individual use. The 500 ml metal cans, which are often marketed as high-performance or extended-use products, are priced higher, typically between $0.81 and $0.90. Additionally, for more budget-conscious or high-consumption users, 1-liter PET bottles are available in the price range of $0.70 to $0.80, offering greater volume at a lower per-unit cost. These pricing tiers reflect a balance between affordability and perceived value, allowing local brands to remain competitive while appealing to a broad spectrum of consumers.

| Packaging Type | Price Range (USD) |

|---|---|

| 250 ml Metal Can | $0.30 – $0.35 |

| 500 ml Metal Can | $0.81 – $0.90 |

| 1 Liter PET Bottle | $0.70 – $0.80 |

Imported products are significantly more expensive; for example, a 250 ml can of Red Bull typically retails for around $1.90, nearly six times the price of local equivalents.

| Channel | Share of Purchases |

|---|---|

| Local grocery stores and markets | 61% |

| Sports clubs and on-the-go kiosks | 18% |

| Hypermarkets and chain stores | 12% |

| Online platforms (e.g., Digikala) | 9% |

Despite the increasing role of online platforms, energy drinks remain a high-turnover product typically bought impulsively or at point-of-need locations such as gyms or small shops.

Future Outlook of Energy Drinks in Iran

The Iranian energy drink market is expected to continue growing, driven by three key trends:

-

Demographic Momentum: A young, urbanizing population with a fast-paced lifestyle.

-

Local Brand Innovation: Domestic brands introducing new flavors and packaging styles.

-

Expanding Distribution: Growth of e-commerce and modern trade improving availability.

However, challenges such as regulatory pressures, health awareness campaigns, and economic fluctuations could impact growth trajectories in the coming years.

Conclusion of Energy Drinks Markets and consumers in Iran

Iran’s energy drink market is entering a new phase of maturity. The insights provided by Myindustry Consulting Group’s 2025 field study show a diversified and competitive environment where local brands are thriving, consumption is high among the youth, and purchasing behavior is driven by energy needs more than social signaling. With the right balance of product innovation and responsible marketing, the market holds promising potential for sustainable expansion.

📢 Looking for Deeper Market Insights?

If you’re exploring opportunities in Iran’s dynamic consumer landscape or require customized market research for a specific product category, Myindustry Consulting Group (MCG) offers data-driven analysis, field studies, and strategic consulting tailored to your business needs.

Contact us today to access actionable intelligence and make confident decisions in one of the region’s most unique and evolving markets.

🎧 Watch the Full Market Briefing

To explore the full findings of our 2025 field study, watch this 16-minute video presentation by Myindustry Consulting Group (MCG). The podcast-style briefing covers all key insights from our in-depth report on the Iranian energy drink market — including consumer behavior, demographic trends, brand competition, pricing structures, and future outlook. This video is ideal for investors, marketers, and researchers seeking a deeper understanding of this fast-evolving segment of Iran’s beverage industry.

👉 Click play below to watch the full market overview.