Iran Dry Fruits Price: Complete Market Overview & Updated Cost Analysis

Understanding Iran Dry Fruits Price Across Domestic and Export Markets

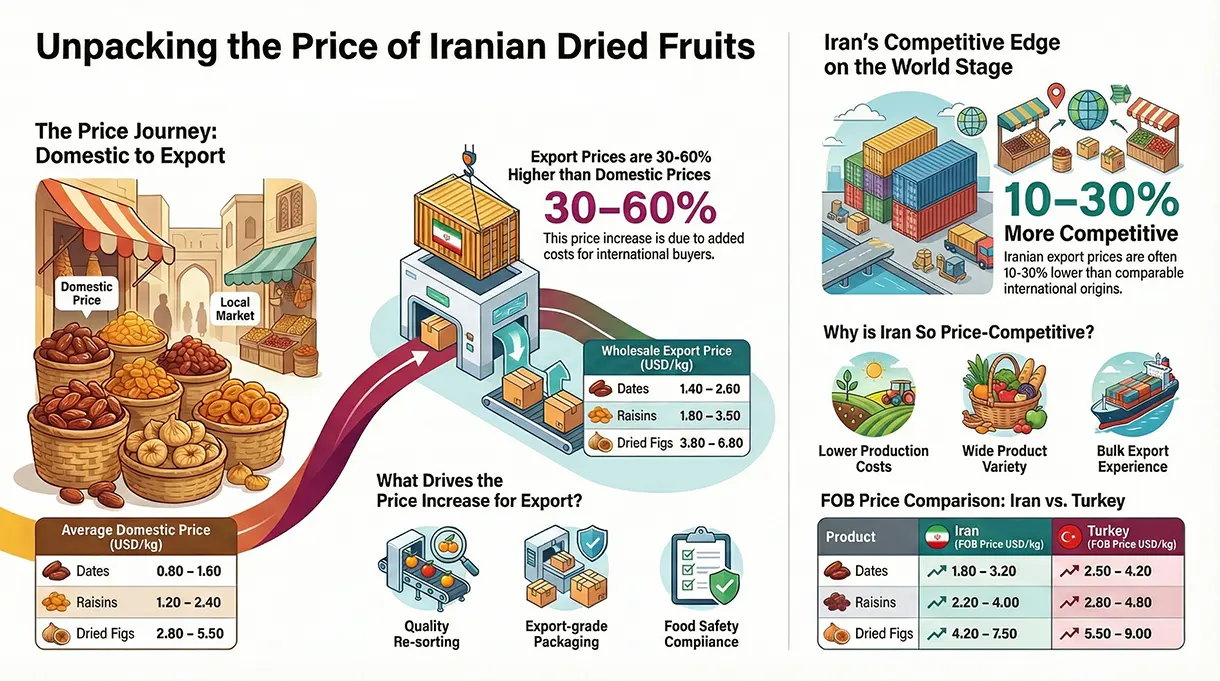

Iran is one of the world’s most important producers of dried fruits, benefiting from a unique combination of climate diversity, long agricultural tradition, and competitive production costs. As a result, Iran dry fruits price has become a key reference point for international buyers, wholesalers, and food importers across Asia, Europe, and the Middle East. (FAO)

Unlike many competing countries, Iran produces a wide spectrum of dried fruits, including dates, raisins, dried figs, apricots, and mixed dried fruit products. This diversity directly influences price structures across domestic and export markets.

Key characteristics of Iran dry fruits pricing include:

-

Strong seasonality linked to harvest cycles

-

Clear differentiation between domestic, wholesale, and export-grade prices

-

High sensitivity to exchange rate fluctuations

-

Competitive pricing compared to regional exporters

Key Insight Box: Why Iran Dry Fruits Price Matters Globally

-

Iran consistently ranks among top global suppliers of dates and raisins

-

Export prices are often 10–30% lower than comparable origins

-

Flexible packaging and grading options attract bulk buyers

Geographic Production Regions and Their Impact on Iran Dry Fruits Price

Iran dry fruits prices vary not only by product type and quality grade, but also by production region. Dates are primarily cultivated in southern provinces such as Kerman, Khuzestan, and Hormozgan, where climate conditions support large-scale production and lower unit costs. Raisins are mainly produced in western and northwestern regions, including Malayer, Zanjan, and East Azerbaijan, while dried figs are concentrated in western provinces such as Fars and Kermanshah. These regional differences directly affect yield, drying methods, logistics distance, and ultimately the final price offered in domestic and export markets. (FAO report about Iran’s figs production)

Current Iran Dry Fruits Price in the Domestic Market

The domestic market forms the pricing foundation for Iran’s dried fruit industry. Local consumption, internal logistics, and seasonal supply determine the baseline cost before products enter export channels.

Domestic prices usually reflect:

-

Farm-gate costs

-

Sorting and drying expenses

-

Local distribution margins

These prices are typically quoted in Iranian Rial, but exporters actively track USD-based equivalents due to currency volatility.

Average Price Range of Dried Fruits in Iran (Domestic Market – USD)

| Product Type | Average Domestic Price (USD/kg) | Key Price Driver |

|---|---|---|

| Dates | 0.80 – 1.60 USD/kg | Variety, harvest season, moisture level |

| Raisins | 1.20 – 2.40 USD/kg | Grape type, drying method, cleanliness |

| Dried Figs | 2.80 – 5.50 USD/kg | Size, color, cracking, moisture |

| Dried Apricots | 2.20 – 4.20 USD/kg | Sulfur treatment, grading, uniformity |

Price Interpretation Box

-

Prices reflect domestic wholesale market levels, not retail

-

Quoted in USD equivalent based on prevailing exchange rates

-

Export-grade products usually trade 25–60% higher than domestic prices

-

Packaging, certification, and logistics are not included (ITC)

📌 Prices vary significantly by region and harvest year.

Market Snapshot Box

Domestic Iran dry fruits prices are usually 20–40% lower than export prices due to:

-

Minimal packaging

-

No international logistics costs

-

Local currency transactions

Retail vs Wholesale Dry Fruits Price in Iran

A major distinction in Iran dry fruits pricing lies between retail and wholesale markets.

Retail prices:

-

Target local consumers

-

Include packaging, branding, and shop margins

-

Less relevant for international benchmarking

Wholesale prices:

-

Used by traders, exporters, and processors

-

Reflect true supply-side economics

-

Serve as the main reference for export negotiations

Wholesale pricing is influenced by:

-

Volume (bulk vs small lot)

-

Sorting and grading level

-

Storage duration

-

Immediate vs delayed delivery

Practical Note for Buyers

If you are analyzing Iran dry fruits price for export, always:

-

Ignore retail prices

-

Focus on wholesale, bulk, and FOB quotations

-

Compare prices by grade, not just by product name

Iran Dry Fruits Price by Product Category

Although the term dry fruits is often used broadly, prices vary substantially between different fruit categories. Each product has its own cost structure based on yield, processing complexity, and export demand.

In the following sections, Iran dry fruits price will be analyzed separately for:

-

Dates

-

Raisins

-

Dried figs

-

Dried apricots and stone fruits

This category-based approach allows buyers and analysts to:

-

Benchmark prices accurately

-

Identify cost-efficient sourcing opportunities

-

Avoid misleading average price comparisons

Iran Dry Fruits Price by Product Category

Although the term dry fruits is often used as a single category, pricing dynamics differ significantly between individual dried fruits. Each product has its own cost structure based on yield per hectare, post-harvest processing, storage requirements, and export demand.

Understanding Iran dry fruits price by product category allows buyers to:

-

Identify cost-efficient sourcing opportunities

-

Avoid misleading average price comparisons

-

Negotiate export contracts more accurately

Dates Price in Iran

Iran is one of the top global producers of dates, with dozens of commercial varieties cultivated across southern provinces. Dates represent the largest volume share of Iran’s dried fruit exports and therefore play a central role in overall pricing benchmarks.

Key factors influencing dates price in Iran:

-

Variety (Mazafati, Kabkab, Zahedi, etc.)

-

Harvest season and crop yield

-

Moisture content and softness

-

Sorting and pit removal

Average Dates Price in Iran (Domestic Wholesale – USD)

| Date Category | Average Price (USD/kg) | Typical Use |

|---|---|---|

| Soft dates | 0.80 – 1.30 | Domestic & regional export |

| Semi-dry dates | 1.00 – 1.60 | Bulk export |

| Premium export-grade dates | 1.60 – 2.50 | International retail & food industry |

Market Insight Box

Dates prices in Iran are highly seasonal. Immediately after harvest, prices tend to be at their lowest, gradually increasing during off-season storage periods.

Raisins Price in Iran

Iran is also a major global supplier of raisins, particularly seedless and sun-dried varieties. Raisins prices are influenced not only by grape harvest conditions but also by drying techniques and processing standards.

Main pricing determinants for raisins:

-

Grape variety and sugar level

-

Drying method (sun-dried vs shade-dried)

-

Cleaning, sorting, and stem removal

-

Sulfur treatment (if applied)

Average Raisins Price in Iran (Domestic Wholesale – USD)

| Raisins Type | Average Price (USD/kg) | Market Position |

|---|---|---|

| Sun-dried raisins | 1.20 – 1.80 | Bulk & processing |

| Golden raisins | 1.80 – 2.40 | Export-oriented |

| Premium cleaned raisins | 2.40 – 3.20 | Retail & branded export |

Buyer Tip Box

For export purposes, always clarify whether quoted raisins prices include:

-

Sorting level

-

Residual moisture percentage

-

Food safety compliance (aflatoxin limits)

Dried Figs Price in Iran

Dried figs are considered a high-value dried fruit in Iran, particularly those produced in western and southern regions. Unlike dates and raisins, fig prices are strongly influenced by visual quality and size grading.

Key drivers of dried figs pricing:

-

Fruit size and uniformity

-

Natural cracking pattern

-

Color consistency

-

Moisture and softness

Average Dried Figs Price in Iran (Domestic Wholesale – USD)

| Grade | Average Price (USD/kg) | Typical Buyer |

|---|---|---|

| Industrial grade | 2.80 – 3.50 | Processing industry |

| Standard export grade | 3.50 – 4.50 | Wholesale exporters |

| Premium export grade | 4.50 – 5.50 | High-end markets |

Quality Note Box

In dried figs, visual grading often matters more than taste for export pricing, especially in EU and East Asian markets.

Dried Apricots and Stone Fruits Price in Iran

Dried apricots and other stone fruits represent a smaller but growing segment of Iran’s dried fruit market. Prices in this category are particularly sensitive to processing methods and sulfur treatment.

Average Dried Apricots Price in Iran (USD/kg)

| Product Type | Average Price (USD/kg) |

|---|---|

| Natural dried apricots | 2.20 – 3.20 |

| Sulfur-treated apricots | 3.00 – 4.20 |

Summary Box: Product-Level Price Differentiation

-

Dates → volume-driven pricing

-

Raisins → process-driven pricing

-

Figs → quality-driven pricing

-

Apricots → treatment-driven pricing

Iran Dry Fruits Export Price Analysis

While domestic prices form the base of Iran’s dried fruit market, export prices reflect a more complex cost structure. These prices incorporate international standards, logistics, currency exposure, and buyer-specific requirements.

For international buyers, Iran dry fruits price for export is typically quoted under:

-

Wholesale (Ex-warehouse Iran)

-

FOB (Free On Board)

-

CIF (Cost, Insurance, Freight)

Each pricing model serves a different buyer profile and risk preference.

Wholesale Iran Dry Fruits Price for Export

Wholesale export prices are usually negotiated directly between exporters and bulk buyers before international shipping costs are added. These prices are often 30–60% higher than domestic wholesale levels, depending on quality and preparation.

Indicative Wholesale Export Prices of Iran Dry Fruits (USD/kg)

| Product | Domestic Price (USD/kg) | Wholesale Export Price (USD/kg) |

|---|---|---|

| Dates | 0.80 – 1.60 | 1.40 – 2.60 |

| Raisins | 1.20 – 2.40 | 1.80 – 3.50 |

| Dried Figs | 2.80 – 5.50 | 3.80 – 6.80 |

| Dried Apricots | 2.20 – 4.20 | 3.20 – 5.80 |

Export Pricing Insight Box

The largest price jump from domestic to export markets is driven by:

-

Quality selection and re-sorting

-

Export-grade packaging

-

Compliance with food safety standards

FOB and CIF Price Structure of Iranian Dry Fruits

Understanding FOB and CIF pricing is critical for accurate cost comparison between suppliers.

FOB Price (Free On Board – Iranian Port)

Includes:

-

Product cost

-

Processing and packaging

-

Inland transportation

-

Customs clearance

CIF Price (Delivered to Destination Port)

Includes:

-

FOB price

-

International freight

-

Insurance

Typical FOB and CIF Price Ranges (USD/kg)

| Product | FOB Price Range | CIF Price Range* |

|---|---|---|

| Dates | 1.80 – 3.20 | 2.30 – 4.10 |

| Raisins | 2.20 – 4.00 | 2.90 – 5.20 |

| Dried Figs | 4.20 – 7.50 | 5.30 – 9.20 |

| Dried Apricots | 3.50 – 6.50 | 4.60 – 8.00 |

*CIF prices vary by destination, shipment size, and freight conditions.

Buyer Note Box

When comparing Iran dry fruits price with other origins, always:

-

Compare FOB to FOB or CIF to CIF

-

Confirm port of loading

-

Check whether palletization and labeling are included

Factors Affecting Iran Dry Fruits Price

Several macro and micro factors influence dried fruit prices in Iran. These factors explain both short-term volatility and long-term competitiveness.

Exchange Rate and Currency Fluctuations

Iran’s dried fruit exports are highly sensitive to exchange rate movements. A weaker local currency generally:

-

Improves export competitiveness

-

Increases exporter margins

-

Attracts short-term bulk buyers

However, it may also increase:

-

Packaging costs

-

Imported input prices

Harvest Season and Crop Yield

Dried fruit prices follow predictable seasonal cycles:

-

Post-harvest period → lowest prices

-

Mid-season storage period → gradual increase

-

Pre-harvest months → peak prices

Weather conditions and yield variability can amplify these cycles.

Quality Grades, Moisture Level, and Sorting

Export buyers typically demand:

-

Tight moisture control

-

Uniform size grading

-

Minimal defects and foreign matter

Higher quality requirements translate directly into higher prices.

Quality Control Box

For dried fruits, even a 1–2% change in moisture level can significantly affect:

-

Shelf life

-

Customs acceptance

-

Final pricing

Packaging, Storage, and Logistics Costs

Export-grade packaging (cartons, vacuum bags, pallets) and cold or dry storage add measurable cost layers. Logistics constraints may further widen the gap between domestic and export prices.

Cost Structure Summary Box

Iran dry fruits export prices =

Base product cost + processing + packaging + compliance + logistics

Iran Dry Fruits Price Trend and Market Outlook

Understanding price trends is essential for both short-term purchasing decisions and long-term sourcing strategies. Over the past decade, Iran dry fruits price has shown a generally upward trend in USD terms, driven by global demand growth and rising logistics costs, despite periodic currency-related fluctuations.

Key price trend observations:

-

Domestic prices fluctuate more frequently due to currency movements

-

Export prices are relatively more stable

-

Premium-grade dried fruits show faster price appreciation

-

Storage and inventory management increasingly affect seasonal pricing

Iran Dry Fruits Price Trend: Key Drivers

| Driver | Impact on Price |

|---|---|

| Exchange rate volatility | High |

| Export demand growth | Medium to high |

| Climate and yield variability | Medium |

| Global freight costs | Medium |

Market Outlook Box

In the medium term, Iran dry fruits prices are expected to:

-

Remain globally competitive

-

Show moderate annual growth

-

Maintain strong demand in Asia, Middle East, and Eastern Europe

Comparison of Iran Dry Fruits Price with Global Markets

Iran competes directly with several major dried fruit exporters. Price comparison must consider quality, grade, and shipment terms, not just headline numbers.

Indicative Export Price Comparison (USD/kg – FOB)

| Origin | Dates | Raisins | Dried Figs |

|---|---|---|---|

| Iran | 1.80 – 3.20 | 2.20 – 4.00 | 4.20 – 7.50 |

| Turkey | 2.50 – 4.20 | 2.80 – 4.80 | 5.50 – 9.00 |

| Uzbekistan | 2.10 – 3.80 | 2.40 – 4.50 | Limited supply |

Data Sources & Methodology

Prices are based on wholesale market observations, exporter quotations, and regional trade benchmarks. Figures represent indicative ranges and may vary by season and contract terms.

Competitive Advantage Box

Iran’s key advantages in dried fruits pricing:

-

Lower production and labor costs

-

Wide product variety

-

Flexible grading and packaging

-

Strong experience in bulk export

How to Buy Dry Fruits from Iran at Competitive Prices

For international buyers, achieving the best Iran dry fruits price depends on sourcing strategy, not just supplier selection.

Recommended sourcing approaches:

-

Buy directly from producers or processors for large volumes

-

Work with experienced exporters for compliance-heavy markets

-

Align purchase timing with post-harvest supply peaks

Key negotiation factors:

-

Minimum order quantity (MOQ)

-

Quality and grade definition

-

Moisture and defect tolerance

-

Packaging and labeling requirements

Practical Buyer Checklist Box

Before finalizing a deal, always confirm:

-

Product grade and specifications

-

Incoterms (FOB vs CIF)

-

Lead time and shipment schedule

-

Payment method and currency

Frequently Asked Questions About Iran Dry Fruits Price

What is the average Iran dry fruits price?

Average prices vary by product, but most dried fruits range between 1.5 and 6.0 USD/kg depending on quality and export terms.

Why are Iran dry fruits prices competitive?

Lower production costs, favorable climate, and efficient bulk processing keep prices attractive compared to other origins.

Are Iran dry fruits prices stable for long-term contracts?

Yes, especially when contracts are structured with:

-

Clear quality definitions

-

Flexible currency clauses

-

Seasonal delivery planning

Conclusion: Is Iran Dry Fruits Price Attractive for Buyers?

Iran remains one of the most cost-effective and diverse sources of dried fruits globally. When analyzed by product category, quality grade, and export terms, Iran dry fruits price consistently offers strong value for wholesalers, importers, and food processors.

Key takeaways:

-

Domestic prices provide a competitive sourcing base

-

Export prices remain attractive despite global cost pressures

-

Product-specific analysis is essential for accurate benchmarking

If you are comparing suppliers, scroll back to the FOB/CIF table and benchmark Iran against your target origin.

Final Insight Box

For buyers seeking a balance between price, quality, and supply reliability, Iran continues to be a strategic origin in the global dried fruits market.

Read more: Iran’s chocolate industry