Barite Powder Price in Iran (2026) | Suppliers, Grades & Export Guide

Current Barite Powder Price in Iran & List of Trusted Suppliers

Barite powder (barium sulfate, BaSO₄) is a strategic industrial mineral widely used in oil & gas drilling, chemical production, and industrial fillers. In recent years, increasing international demand has drawn attention to the barite powder price in Iran, as the country is recognized as one of the important barite-producing nations in the Middle East. Supported by abundant mineral reserves and a long-established mining sector, barite powder suppliers in Iran are able to offer competitive pricing, stable supply, and export-ready production for regional and global markets.

This page is designed as a practical reference for buyers searching for barite powder price in Iran and reliable barite powder suppliers in Iran.

In recent years, growing demand from energy and industrial markets has increased international interest in the barite powder price in Iran, particularly among buyers seeking competitive alternatives to traditional suppliers such as China, India, and Morocco. Iran’s advantage lies in its combination of relatively high-grade reserves, competitive production costs, and proximity to major export routes. (Read more on US geological Survey on Mineral Summaries – Barite)

This guide provides an up-to-date and market-oriented overview of the current barite powder price in Iran, along with a practical framework for identifying reliable barite powder suppliers in Iran. The analysis is designed for international buyers, traders, and industrial users who require transparent pricing, technical clarity, and export-ready supply.

Current Barite Powder Price in Iran & List of Trusted Suppliers

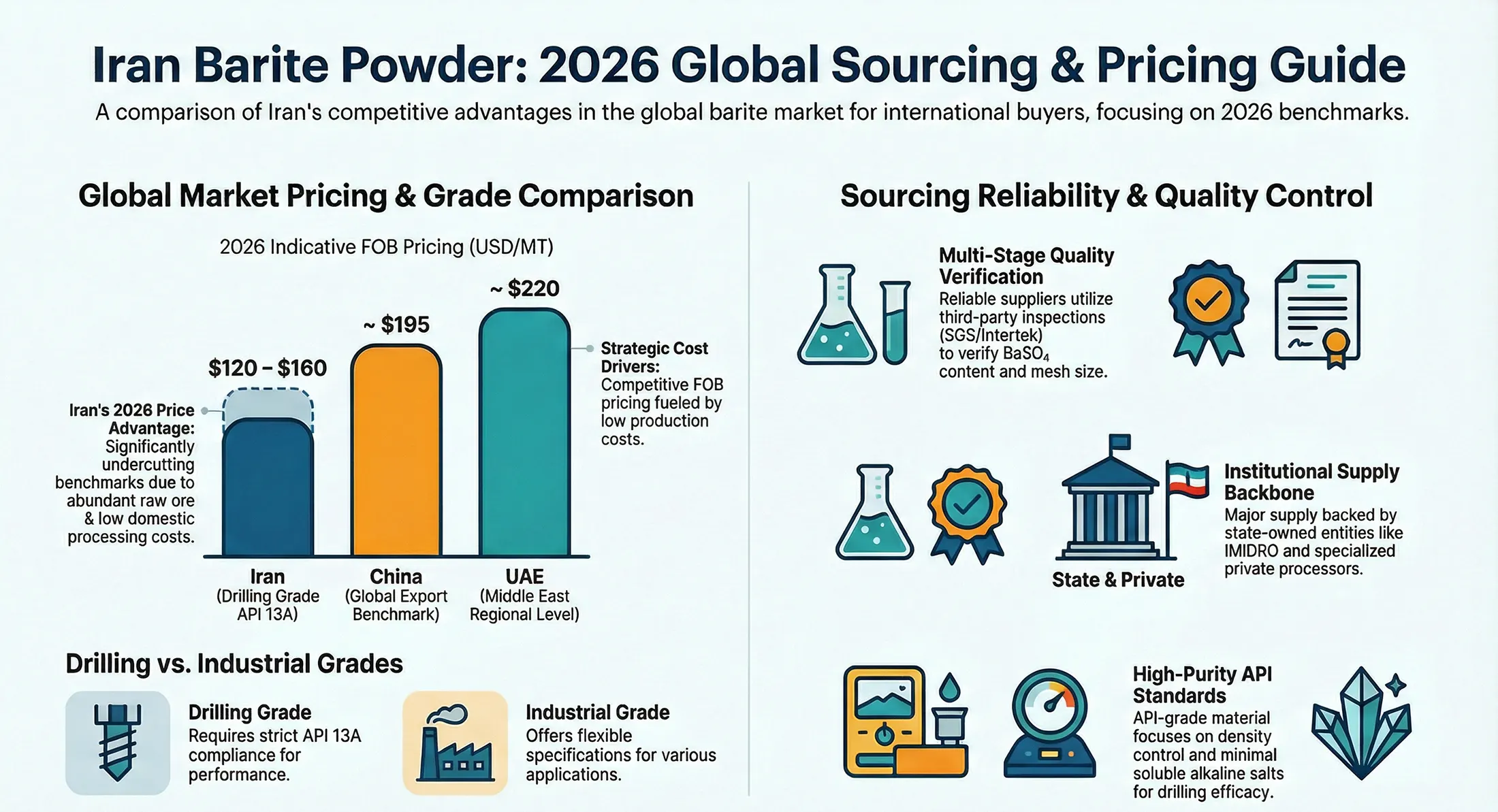

The barite powder price in Iran is primarily determined by mineral grade, BaSO₄ content, particle size (mesh), processing level, and logistics to export terminals. As of 2026, Iran offers a broad pricing spectrum that reflects both industrial-grade material and higher-purity barite suitable for oil and gas drilling applications.

On average, Iranian barite powder remains cost-competitive compared to major global suppliers, particularly when evaluated on a FOB basis. This price advantage is driven by domestic availability of raw ore, lower extraction costs, and a well-established network of mineral processors located near key mining regions.

Typical price ranges vary depending on specification:

-

Drilling-grade barite (API-compliant) commands a premium due to stricter quality control and higher BaSO₄ purity requirements.

-

Industrial-grade barite powder used in paints, plastics, rubber, and fillers is priced lower, reflecting broader tolerance ranges in specifications.

Identifying reliable barite powder suppliers in Iran is a critical step for international buyers. The supplier landscape includes mine owners with in-house processing facilities, specialized mineral processors, and export-oriented trading companies. Trusted suppliers typically demonstrate:

-

Proven production capacity and consistent output

-

Compliance with international standards such as API 13A for drilling-grade barite

-

Independent inspection reports (e.g., SGS or Intertek)

-

Experience with export logistics and documentation

Iran’s major barite-producing regions—such as Kerman, Semnan, and South Khorasan—host clusters of experienced producers supplying both domestic industries and export markets. Buyers sourcing from these regions benefit from shorter supply chains and more transparent cost structures. (Based on Iranian Ministry of Industry, Mine and Trade. Non-metallic minerals production data.)

Average Barite Powder Price in Iran (2026 Update)

The average barite powder price in Iran in 2026 varies depending on grade, purity level, particle size, and intended application. In general, Iran remains a cost-competitive source in the global market due to domestic availability of raw barite ore and relatively low processing costs.

For export-oriented transactions, prices are commonly quoted on a per-metric-ton basis and may differ between mine-processed material and fully refined barite powder. Drilling-grade barite that meets oil and gas industry standards typically trades at a higher range compared to industrial-grade material used in paints, plastics, or construction fillers. Buyers should note that pricing is usually negotiated based on technical specifications rather than fixed market listings.

| Grade / Market | Approx. Price (USD/MT) | Notes |

|---|---|---|

| Iran – Drilling Grade (API 13A) | 120 – 160 | Indicative (FOB / Negotiable) |

| Iran – Industrial Grade | 90 – 120 | Indicative (FOB / Negotiable) |

| China – Export (Reference) | ~195 | Global benchmark price band |

| UAE – Regional Price | ~220 | Typical Middle East regional level |

| USA – Reference Market | ~165 | Spot price index reference |

The table above reflects the indicative barite powder price in Iran compared with major global reference markets in 2026.

Factors Affecting Barite Powder Price in Iran

Several technical and commercial factors directly influence the barite powder price in Iran, making specification alignment a critical step in procurement. One of the most important variables is BaSO₄ content, as higher purity material requires additional beneficiation and quality control. Mesh size also plays a key role; finer powders demand more advanced milling processes, increasing production costs.

Logistics is another decisive element. Transportation from inland mining regions to southern ports can significantly affect FOB pricing, especially for bulk shipments. In addition, packaging format (jumbo bags, 25-kg bags, or bulk) and inspection requirements may add to the final cost. From a commercial perspective, order volume and long-term supply agreements often allow buyers to negotiate more favorable terms.

-

BaSO₄ content and overall purity level

-

Mesh size and degree of particle fineness

-

Distance from mining areas to export ports and logistics routes

-

Packaging format (jumbo bags, 25-kg bags, or bulk shipments)

-

Inspection, testing, and quality verification requirements

-

Order volume and shipment size

-

Long-term supply agreements and repeat purchasing arrangements

Barite Powder Suppliers in Iran: How to Identify Reliable Producers

The landscape of barite powder suppliers in Iran includes mine owners, mineral processing companies, and export-focused trading firms. Reliable suppliers are typically those with direct access to barite mines and in-house grinding facilities, allowing better control over quality consistency and delivery timelines.

International buyers should prioritize suppliers that can demonstrate technical documentation, stable production capacity, and experience with export procedures. Transparency in specifications, willingness to provide third-party inspection reports, and familiarity with international trade terms are strong indicators of supplier credibility. Geographic concentration in established mining provinces also tends to correlate with operational reliability and cost efficiency.

| Company | Ownership Type | Role in Barite & Industrial Minerals | Market Position |

|---|---|---|---|

| Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO) | State-owned | Policy-making, development, and supervision of large-scale mining projects, including non-metallic minerals | National-level authority |

| Iran Minerals Production and Supply Company (IMPASCO) | State-owned subsidiary | Exploration, extraction, and supply of industrial minerals through state mining assets | Upstream producer |

| Middle East Mines and Mining Industries Development Holding Company (MIDHCO) | Semi-state (public holding) | Investment and participation in mining and mineral processing projects, including industrial minerals | Large-scale holding |

| IMIDRO Regional Subsidiaries and Affiliated Mining Companies | State-affiliated | Operation and supervision of regional non-metallic mineral projects through affiliated entities | Regional supply base |

API Grade Barite Powder in Iran

API grade barite powder represents the highest specification level in the Iranian market and is primarily used in oil and gas drilling fluids. This grade must comply with strict physical and chemical requirements, particularly minimum barium sulfate content, controlled particle size distribution, and limits on soluble alkaline salts.

In Iran, API grade barite is typically produced by suppliers with access to higher-purity ore bodies and advanced beneficiation facilities. Quality consistency is a critical factor, as deviations from API standards can directly affect drilling fluid density and wellbore stability. As a result, API-grade material is usually subject to tighter quality control procedures compared to other barite products.

Drilling Grade vs Industrial Grade Barite Powder

Barite powder in Iran is broadly categorized into drilling grade and industrial grade, each serving distinct end-use markets. Drilling-grade barite is designed for oil and gas applications where density control and suspension stability are essential. This grade requires narrower tolerance ranges and more rigorous testing protocols.

Industrial-grade barite powder, on the other hand, is used in applications such as paints, plastics, rubber, and construction materials. These applications generally allow wider specification ranges, making industrial-grade material more flexible in terms of raw ore quality and processing requirements. The difference in performance expectations between these two grades is a key reason for pricing variation within the Iranian barite market.

Barite Powder Specifications (BaSO₄ %, Mesh Size, Moisture)

Technical specifications play a decisive role in determining both usability and market value of barite powder. BaSO₄ content is the primary quality indicator, as higher purity enhances density and chemical stability. Mesh size defines particle fineness and directly affects flow behavior and dispersion in end-use applications.

Moisture content is another important parameter, particularly for export shipments. Excess moisture can increase transportation costs and reduce handling efficiency. For this reason, reputable producers in Iran typically offer clearly defined specification sheets covering purity, particle size distribution, and moisture limits to meet international buyer requirements.

Barite Powder HS Code and Export Classification

For international trade purposes, barite powder exported from Iran is classified under a specific Harmonized System (HS) code used for customs clearance and trade documentation. Correct classification is essential, as it determines applicable duties, inspection requirements, and compatibility with importing country regulations.

Export-grade barite powder is typically declared based on its processed form rather than raw ore, reflecting its industrial or drilling-grade application. Accurate HS classification helps minimize customs delays and ensures transparency in cross-border transactions, particularly for buyers sourcing from Iran for the first time.

Packaging Options for Barite Powder Export

Packaging plays an important role in preserving product quality and optimizing logistics costs during export. Iranian suppliers commonly offer barite powder in several standard formats to accommodate different shipping and handling requirements.

Jumbo bags are widely used for bulk industrial buyers due to their cost efficiency and ease of handling at ports. For smaller or more controlled shipments, 25-kg bags are preferred, especially when the material is destined for downstream processing or resale. Bulk shipments may also be arranged for large-volume buyers with appropriate unloading infrastructure. The choice of packaging directly affects handling efficiency, storage conditions, and overall shipment cost.

FOB and CIF Barite Powder Prices from Iran

Export pricing for barite powder from Iran is typically quoted on either an FOB or CIF basis, depending on buyer preference and logistics arrangements. FOB pricing reflects the cost of the product loaded at the export port, allowing buyers to manage freight and insurance independently. CIF pricing, by contrast, includes transportation and insurance up to the destination port, offering greater convenience for buyers seeking simplified procurement.

The difference between FOB and CIF prices can be significant, influenced by freight rates, shipping routes, and insurance terms. Understanding these pricing structures enables buyers to accurately compare offers from Iranian suppliers with those from other international markets and select the most cost-effective sourcing strategy.

Why International Buyers Source Barite Powder from Iran

Iran has emerged as a competitive sourcing destination for barite powder due to a combination of geological advantages and established industrial infrastructure. The country hosts multiple high-quality barite deposits and benefits from decades of experience in mineral extraction and processing. These factors allow Iranian suppliers to maintain consistent output levels while offering pricing that remains attractive in comparison with many global competitors.

In addition, Iran’s geographic position provides access to regional and international shipping routes, supporting exports to the Middle East, Asia, and parts of Europe. For buyers seeking supply diversification and cost efficiency, sourcing barite powder from Iran represents a strategic alternative within the global minerals market.

Competitive Pricing Compared to Other Barite-Producing Countries

One of the main drivers behind growing interest in the barite powder price in Iran is its competitive positioning relative to major producers such as China and India. Lower extraction costs, domestic availability of raw materials, and localized processing facilities contribute to favorable price structures.

While prices may vary depending on grade and specification, Iranian barite powder often offers a balanced combination of cost and quality. This positioning allows buyers to optimize procurement budgets without compromising on essential technical requirements, particularly in drilling and industrial applications.

Production Capacity and Supply Stability

Supply reliability is a critical concern for industrial buyers, especially in energy-related sectors. Iran’s barite industry benefits from diversified mining regions and multiple processing centers, reducing dependence on a single source or facility. This distributed structure enhances supply stability and mitigates risks associated with localized disruptions.

Large-scale producers and affiliated entities typically maintain sufficient stock levels and production capacity to support long-term contracts. For international buyers, this translates into predictable delivery schedules and reduced risk of supply interruptions.

How to Buy Barite Powder from Reliable Suppliers in Iran

Purchasing barite powder from Iran requires a structured approach focused on specification clarity and supplier verification. Buyers typically begin by defining technical requirements, including grade, purity, mesh size, and packaging preferences. Clear documentation at this stage helps avoid misunderstandings and ensures accurate quotations.

Engaging with suppliers that have prior export experience and established quality control procedures is essential. Transparent communication, sample evaluation, and alignment on delivery terms form the foundation of a successful procurement process in the Iranian market.

Step-by-Step Buying Process for Foreign Importers

The procurement process usually starts with an initial inquiry outlining technical specifications and expected order volume. This is followed by quotation review, sample approval, and confirmation of commercial terms. Once contractual details are finalized, production scheduling and inspection arrangements are made prior to shipment.

After completion of packaging and documentation, the cargo is prepared for export according to agreed Incoterms. Understanding each step of this process enables foreign importers to manage timelines effectively and reduce operational risks when sourcing barite powder from Iran.

Payment Methods and Trade Limitations

International transactions involving barite powder from Iran are typically structured around alternative payment mechanisms due to banking and financial restrictions. Buyers and sellers often rely on indirect payment channels, regional intermediaries, or structured trade arrangements to complete transactions securely.

From a commercial standpoint, clarity on payment terms at an early stage is essential. Well-defined payment structures help reduce risk exposure for both parties and ensure smoother execution of contracts, particularly for first-time buyers entering the Iranian minerals market.

Quality Control and Inspection Practices

Quality assurance is a critical component of barite powder procurement, especially for export-oriented shipments. Reputable suppliers in Iran apply internal quality control procedures throughout extraction, processing, and packaging stages to ensure consistency with declared specifications.

Independent inspection prior to shipment is commonly used to verify parameters such as BaSO₄ content, particle size distribution, and moisture level. These practices help international buyers mitigate technical risks and maintain confidence in product performance across different applications.

Documentation and Compliance Requirements

Exporting barite powder from Iran involves a set of standard commercial and technical documents. These typically include commercial invoices, packing lists, certificates of origin, and quality documentation aligned with the intended application of the product.

Accurate documentation plays a vital role in customs clearance and regulatory compliance in destination markets. Suppliers experienced in export procedures are better positioned to ensure documentation accuracy and reduce the likelihood of delays or disputes during cross-border transactions.

Common Risks in Sourcing Barite Powder from Iran

As with any international procurement process, sourcing barite powder from Iran involves certain operational and commercial risks. These may include specification mismatches, logistics delays, or misunderstandings related to packaging and delivery terms.

Risk mitigation relies heavily on supplier due diligence, clear technical communication, and structured contractual arrangements. Buyers who invest time in supplier evaluation and pre-shipment verification generally experience smoother sourcing outcomes.

Request Pricing & Supplier Assessment

If you are evaluating sourcing options and would like tailored insights on current barite powder prices in Iran or assistance in identifying reliable barite powder suppliers in Iran, please complete the inquiry form below.

Providing your technical requirements will help ensure accurate pricing benchmarks and supplier matching based on your intended application and delivery terms.

Contact Myindustry Consulting Group (MCG)

Conclusion

Iran has established itself as a competitive and reliable sourcing destination in the global barite market. Backed by abundant mineral reserves, diversified production regions, and experienced processing infrastructure, the barite powder price in Iran remains attractive for both drilling and industrial applications. At the same time, the presence of state-owned, semi-state, and private producers provides international buyers with multiple sourcing pathways and supply stability.

For buyers seeking transparent pricing, technical compliance, and export-ready supply, evaluating specifications carefully and working with experienced barite powder suppliers in Iran is essential. With the right procurement approach, Iran represents a strategic option for cost-efficient and dependable barite powder sourcing in 2026 and beyond.

International buyers often seek clarity on pricing variability, supplier reliability, and export feasibility when evaluating the Iranian barite market. Questions commonly focus on quality consistency, minimum order volumes, and suitability for specific industrial applications.

Addressing these concerns through transparent technical information and clear commercial frameworks helps establish trust and positions Iran as a credible sourcing destination within the global barite supply chain.

Data Sources and Update Policy

This analysis is based on a combination of publicly available industry reports, government mining statistics, and market-based pricing benchmarks. Price ranges are indicative and reflect typical FOB export quotations observed in international trade, adjusted for grade, purity, and specification differences.

The content is reviewed and updated periodically to reflect changes in market conditions, production capacity, and export dynamics. All numerical references should be interpreted as guidance rather than fixed offers, as final pricing depends on technical requirements, order volume, and delivery terms.

Frequently Asked Questions About Barite Powder Price and Suppliers in Iran

What is the current barite powder price in Iran?

As of 2026, the barite powder price in Iran typically ranges between USD 90–160 per metric ton, depending on grade and specifications. (Reference: https://www.imarcgroup.com/barite-pricing-report)

The barite powder price in Iran varies depending on grade, purity, mesh size, and delivery terms. Drilling-grade barite generally trades at a higher price range than industrial-grade material, while export prices are typically quoted on an FOB or CIF basis. Pricing is usually negotiable and finalized after technical specifications are confirmed.

Why is barite powder from Iran considered cost-competitive?

Iran benefits from abundant barite reserves, domestic processing capacity, and relatively low extraction costs. These factors allow Iranian suppliers to offer competitive pricing compared to many global producers, particularly for buyers sourcing large volumes or entering long-term supply agreements.

Who are the main barite powder suppliers in Iran?

Barite powder suppliers in Iran include state-owned and semi-state mining entities, private mineral processors, and export-oriented trading companies. Reliable suppliers are typically those with direct access to mines, in-house processing facilities, and prior experience with international shipments.

Is Iranian barite powder suitable for oil and gas drilling applications?

Yes. Iran produces API-compliant drilling-grade barite powder that meets the requirements of oil and gas drilling fluids. Buyers should always verify specifications such as BaSO₄ content, particle size distribution, and moisture levels before finalizing procurement.

What specifications should buyers check before purchasing barite powder from Iran?

Key specifications include barium sulfate (BaSO₄) percentage, mesh size, moisture content, and compliance with application-specific standards. Clear specification alignment is essential to ensure performance consistency and avoid technical issues after delivery.

How is barite powder typically packaged for export from Iran?

Common export packaging options include jumbo bags, 25-kg bags, and bulk shipments. The choice of packaging depends on shipment size, handling infrastructure, and buyer preference, and it can influence both logistics efficiency and final pricing.

What are the main risks when sourcing barite powder from Iran?

Potential risks include specification mismatches, logistics delays, and misunderstandings regarding delivery terms or documentation. These risks can be mitigated through supplier due diligence, sample testing, and independent inspection prior to shipment.

How can foreign buyers ensure reliable sourcing from Iran?

Reliable sourcing is best achieved by working with experienced suppliers, clearly defining technical and commercial requirements, and following a structured procurement process. Buyers who prioritize transparency and verification generally experience more stable and predictable outcomes.