Clinker in Iran: Market Insights and Opportunities

Top Iranian Clinker Producers, Export Trends, and Investment Opportunities in 2025

Iran has established itself as one of the leading producers and exporters of clinker in the global market, making it a strategic source for importers and construction industry stakeholders worldwide. With its vast reserves of high-quality limestone, competitive production costs, and access to key shipping routes, Iran plays a central role in supplying clinker to high-demand regions such as the Middle East, East Africa, and South Asia.

Iranian Clinker Market

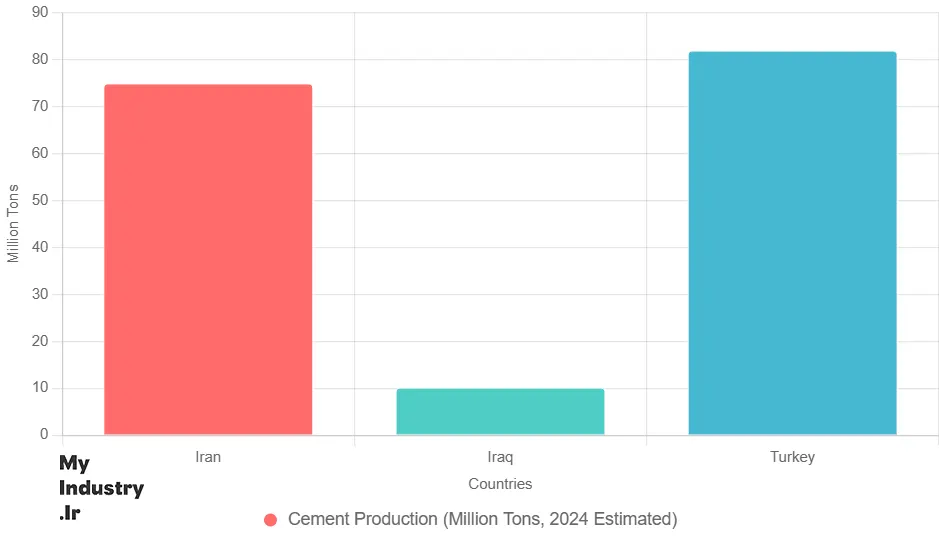

The Iranian clinker market offers a rare combination of scale, quality, and pricing advantages. The country’s annual clinker production capacity exceeds 80 million tons, enabling both a robust domestic supply and a strong export presence. In recent years, Iran has consistently ranked among the top exporters, shipping millions of tons to neighboring and emerging markets where domestic production is limited. This stable supply chain, coupled with cost-effective manufacturing, gives Iran a competitive edge for long-term trade partnerships.

For foreign businesses, Iran’s clinker industry presents opportunities on multiple fronts:

-

Direct imports of bulk clinker at competitive prices.

-

Joint ventures with local manufacturers to secure production capacity.

-

Participation in logistics and supply chain solutions for regional distribution.

Despite geopolitical and regulatory challenges, Iran’s clinker exports continue to grow, supported by steady demand from countries investing heavily in infrastructure. Importers benefit from shorter transit times compared to suppliers in other continents, as well as flexible shipment sizes tailored to project needs.

Understanding the market dynamics is crucial for maximizing these opportunities. Export trends, seasonal demand fluctuations, and price movements in Iran are influenced by both domestic construction activity and regional economic conditions. Moreover, navigating customs regulations, payment channels, and contractual terms requires reliable market intelligence and local partnerships.

Overview of the Clinker Industry in Iran

Production Capacity and Scale

According to the Iranian Cement Association (2024), Iran’s annual clinker production capacity exceeds 80 million tons, placing the country among the top 10 clinker producers globally. This level of output not only meets domestic cement demand but also fuels a strong export sector. Abundant limestone reserves, competitive energy prices, and skilled labor contribute to cost-effective yet high-quality production.

Key Production Hubs

Iran’s major clinker plants are concentrated in several industrially advanced provinces:

-

Isfahan – home to some of the country’s largest cement and clinker manufacturing complexes.

-

Fars and Kerman – known for high-quality limestone deposits and modern kiln technology.

-

Khuzestan – strategically located near Persian Gulf export ports.

Many plants are located near transportation corridors and seaports such as Bandar Abbas and Imam Khomeini Port, which reduces logistics costs and ensures faster delivery times for international buyers.

Best Clinker Suppliers in Iran (2025)

Iran is home to some of the largest and most advanced clinker production facilities in the Middle East. These manufacturers not only meet domestic cement demand but also play a key role in supplying high-quality clinker to international markets. Below are some of the top clinker producers in Iran for 2025:

Savéh Cement Company

Located in Markazi Province, Savéh Cement operates both white and gray cement production lines. The plant’s gray line, equipped with modern FLSmidth dry-process kilns, produces up to 7,200 tons of clinker per day. The company is known for consistent product quality and the ability to meet large export orders.

🔗 Saveh Cement Official Website

Tehran Cement Company

As one of the oldest and largest cement plants in Iran, Tehran Cement has a long-standing reputation for producing high-quality clinker used in both domestic and export markets. Its strategic location near the capital ensures strong logistics connectivity for shipments.

🔗 Tehran Cement Official Website

Sufian Cement Company

Based in East Azerbaijan Province, Sufian Cement is recognized for stable clinker output and compliance with international quality standards. Its location near Iran’s northwestern borders offers logistical advantages for exports to the Caucasus and Turkey.

🔗 Sufian Cement Official Website

Sepahan Cement Company

Located in Isfahan Province, Sepahan Cement is one of Iran’s most prominent producers, supplying clinker to both domestic markets and international buyers in the Middle East and Africa.

🔗 Sepahan Cement Official Website

Kerman Cement Company

Situated in Kerman Province, Kerman Cement benefits from abundant high-quality limestone reserves. The company exports clinker to multiple countries in the Persian Gulf and East Africa.

🔗 Kerman Cement Official Website

Why These Suppliers Stand Out

-

Proven capacity to meet large-scale orders.

-

Compliance with international standards such as ASTM C150 and EN 197-1.

-

Strategic locations near export gateways, reducing logistics costs.

-

Strong domestic market presence that ensures operational stability.

Economic Importance

The clinker and cement sector plays a vital role in Iran’s non-oil export revenues. According to the Iran Trade Promotion Organization (2023), clinker exports generated over $400 million last year. Many importers prefer clinker over finished cement because of lower freight costs and the option to grind it locally, which can reduce import duties in certain markets.

Export Orientation

Iran exports clinker to more than 20 countries, with Iraq, Oman, Qatar, East African nations, and South Asian markets among the leading destinations (Global Cement Report, 2023). Competitive pricing, steady supply, and shorter transit times give Iranian suppliers an edge over exporters from other regions, including Southeast Asia and Europe.

Government Support and Challenges

The Iranian government has implemented investment incentives to encourage modernization of production facilities and environmental upgrades. However, the sector still faces challenges such as:

-

Fluctuating global demand

-

Rising competition from countries like Turkey, Vietnam, and Indonesia

-

The need for technology upgrades to meet stricter environmental regulations

Production Process and Quality Standards

Iran produces clinker using high-quality limestone reserves and modern kiln technologies, with many plants meeting ASTM C150 and EN 197-1 standards. Large-scale producers are often ISO 9001-certified, ensuring consistent product quality for export markets.

While some facilities still operate with older equipment, this presents investment opportunities for foreign partners in technology upgrades and energy efficiency improvements. These upgrades can reduce costs, improve environmental performance, and open access to premium markets.

Environmental compliance is also improving, with select plants adopting waste heat recovery and alternative fuels. Green investment initiatives can further enhance market competitiveness, especially in eco-conscious regions.

Addressing Potential Challenges

| Challenge | Practical Solution for Investors |

|---|---|

| Outdated technology in some plants | Partner with manufacturers to modernize equipment; share cost savings and boost quality. |

| Varying quality between producers | Source from certified plants; conduct third-party quality inspections. |

| Environmental compliance pressures | Invest in sustainability upgrades; market clinker as eco-friendly to access premium buyers. |

Market Insights for Clinker in Iran

Domestic Market Trends

Iran’s clinker demand is primarily driven by the domestic cement industry, which supports large-scale infrastructure, housing, and industrial projects. Government-backed construction initiatives and post-earthquake reconstruction programs ensure steady local consumption. Seasonal fluctuations occur, with demand peaking during spring and summer, aligning with optimal construction periods.

Investor Insight: For foreign investors, domestic demand stability means local production capacity is consistently utilized, reducing the risk of idle assets and ensuring predictable supply volumes for export contracts.

Export Market Overview

According to the Iran Trade Promotion Organization (2023), Iran exports clinker to more than 20 countries, with Iraq, Oman, Qatar, Kenya, and Sri Lanka as key destinations. Short transit times and competitive FOB prices make Iranian clinker attractive in regions with limited domestic production.

Investor Insight: By securing long-term supply contracts with Iranian producers, foreign partners can guarantee price stability and supply security, especially during global shortages.

Competitive Advantages of Iranian Clinker

-

Strategic location between high-demand markets in the Middle East, East Africa, and South Asia.

-

Lower production costs due to affordable energy and raw materials.

-

Flexible shipment sizes, from bulk cargo to smaller consignments for niche markets.

Addressing Market Challenges

| Challenge | Investor-Oriented Solution |

|---|---|

| Currency fluctuations | Use USD or EUR-denominated contracts; apply forward exchange agreements. |

| Trade restrictions in certain markets | Target open markets in Africa, South Asia, and GCC where trade channels are active. |

| Seasonal demand changes | Diversify export destinations to balance year-round sales. |

1. Direct Imports of Clinker at Competitive Prices

Bulk clinker imports from Iran are often 10–15% cheaper than equivalent quality from other regions, enabling higher margins for importers.

2. Joint Ventures with Iranian Clinker Manufacturers

Foreign investors can secure a share of production capacity by forming joint ventures with Iranian producers. This reduces supply risk and allows co-branding opportunities in regional markets.

3. Logistics and Cement Supply Chain Solutions

Iran’s strategic location offers potential for re-export hubs. Investors can establish logistics bases near ports such as Bandar Abbas to serve multiple markets efficiently.

4. Technology Transfer and Green Cement Initiatives

Upgrading production lines and implementing green technologies not only improve efficiency but also enable access to premium eco-friendly markets. Foreign expertise in these areas is in demand among Iranian clinker and cement producers.

5. Long-Term Clinker Export Agreements

Securing multi-year supply contracts with Iranian clinker plants can provide price stability and protect against global market volatility.

Challenges and Risks for Clinker in Iran

Like any market, the clinker industry in Iran comes with certain challenges that foreign investors should be aware of. However, most of these risks can be effectively managed through careful planning and strategic partnerships.

One of the primary concerns is currency volatility, which can affect contract pricing and profitability. To address this, many international buyers structure agreements in USD or EUR and include currency adjustment clauses. Using secure payment methods such as confirmed letters of credit (LCs) or escrow arrangements tied to inspection milestones can also safeguard transactions.

Another challenge is the variation in product quality between different suppliers. While many Iranian plants meet ISO 9001 standards and comply with ASTM C150 and EN 197-1 specifications, some smaller or older facilities may have inconsistencies. The solution lies in selecting certified producers and incorporating third-party inspections into supply contracts, ensuring each shipment meets agreed technical parameters.

Infrastructure constraints, such as seasonal port congestion, can occasionally impact shipping schedules. Investors can mitigate this risk by booking shipments in advance, diversifying load ports (e.g., Bandar Abbas, Imam Khomeini Port), and balancing export destinations to maintain steady year-round activity.

Finally, growing environmental expectations in global markets mean that producers will increasingly be judged on sustainability. For investors, this is not just a challenge but an opportunity: partnering with Iranian manufacturers to install waste heat recovery systems or adopt alternative fuels can create a competitive edge and access to premium, eco-conscious buyers.

In short, while operational and market risks exist, they can be transformed into strategic advantages for investors who plan ahead and collaborate closely with established Iranian clinker suppliers.

Regulatory Environment for Clinker in Iran

The regulatory framework for clinker exports from Iran is straightforward but requires attention to detail to avoid delays. All clinker shipments must comply with the relevant customs classification (HS Code 2523.10 for cement clinker) and be accompanied by standard export documentation, including a commercial invoice, packing list, certificate of origin, quality inspection report (SGS, BV, or equivalent), and bill of lading.

Export licenses are issued to qualified producers and traders, and most major manufacturers already hold these permits. Foreign buyers can work directly with licensed exporters or form joint ventures to simplify compliance and gain priority in production scheduling.

Customs clearance in Iran is generally efficient when documents are complete and aligned with destination market requirements. Engaging a local customs broker familiar with clinker exports can significantly reduce processing time and ensure all paperwork meets both Iranian and foreign regulations.

Quality compliance is another critical aspect. Iranian clinker is typically produced in line with international standards, but contracts should specify the technical criteria, testing methods, and acceptance procedures. Many exporters welcome pre-shipment inspections, which provide foreign buyers with independent verification of quality before loading.

From a payment perspective, international transactions are commonly settled via confirmed letters of credit or secure escrow services. This not only protects both parties but also reassures overseas buyers operating under strict corporate compliance guidelines.

Overall, Iran’s clinker export regulations are clear, and with the right local partnerships, foreign investors can navigate them smoothly—turning procedural requirements into a predictable, controlled part of the trade process rather than a barrier.

Future Outlook for Clinker in Iran

The outlook for the Iranian clinker market over the next five years is highly promising. Global demand for cement and clinker is expected to remain strong, driven by infrastructure growth in emerging economies, post-disaster reconstruction projects, and urban expansion in Asia, Africa, and the Middle East.

Iran is strategically positioned to capitalize on this demand. With abundant raw materials, competitive production costs, and proximity to high-growth markets, the country is poised to maintain and even expand its export share. Government plans for industrial modernization and the growing adoption of environmentally friendly production technologies will further enhance the competitiveness of Iranian clinker.

For foreign investors and buyers, the coming years represent a window of opportunity to establish strong supply chains, secure long-term contracts, and partner with reputable local producers before global competition intensifies. Those who act early are likely to benefit from favorable pricing, priority production allocation, and stronger relationships in the Iranian market.

Conclusion

Iran’s clinker industry offers a rare blend of scale, cost efficiency, quality, and strategic location. Despite certain operational and market challenges, the combination of abundant resources, skilled labor, and established export channels makes clinker in Iran a valuable and reliable commodity for international buyers.

By engaging with the market through direct imports, joint ventures, or technology and sustainability partnerships, foreign businesses can not only secure a stable supply but also position themselves competitively in their own markets. The key lies in leveraging local expertise, navigating regulations effectively, and locking in advantageous agreements while the market conditions remain favorable.

At Myindustry Consulting Group, we specialize in helping international companies access the Iranian clinker market with confidence and efficiency. Our services include:

-

Market research and intelligence on clinker production and export trends in Iran

-

Identification of certified and reliable clinker suppliers

-

Assistance with contract negotiation, regulatory compliance, and customs procedures

-

Support in securing competitive freight solutions and long-term supply agreements

Whether you are looking to import clinker, establish a joint venture, or explore investment opportunities in the Iranian cement industry, we provide the local knowledge and global trade expertise to make it happen.

📩 Contact Myindustry Consulting Group today to discuss how we can help you unlock the full potential of the clinker market in Iran. Secure your position in one of the most competitive and strategically located markets in the world—before your competitors do.

Consultation form

To read more: Canadian Cement Association