Drink Industry in Iran: Market Trends & Opportunities

Key Drivers & Consumer Insights in Iran’s Beverage Market

Iran’s drink industry—primarily focused on non-alcoholic beverages—has witnessed consistent growth over the past decade. According to various local economic reports, the market value of non-alcoholic beverages in Iran surpassed USD 4.5 billion (Mehr News Agency, 2022) in 2022, showing a steady annual growth rate of 5–7%. Despite international challenges, domestic production and consumer demand have remained robust, underpinned by a culturally rich tradition of tea consumption and a rapidly diversifying product range that includes juices, dairy-based beverages, and herbal drinks. (Drink Industry in Iran)

Drink Industry in Iran: Market Trends

- Rising Demand for Healthy Options

Consumers are increasingly seeking beverages with lower sugar content, natural ingredients, and functional benefits—such as vitamin-fortified juices and herbal infusions. - Technological Upgrades in Production

Beverage manufacturers are investing in modern machinery for pasteurization, packaging, and cold-chain logistics, improving product shelf life and quality. - Growth of Private Brands

Supermarkets and hypermarkets now stock private-label drinks, often priced more competitively than established brands, which broadens consumer choice. - Export Opportunities

Non-alcoholic Iranian beverages, particularly fruit concentrates and herbal syrups, have found niche markets in neighboring countries. Exports currently represent an estimated 10–15% of total domestic production.

Opportunities in the Market

- Innovative Formulations: There’s an untapped segment for energy drinks, flavored dairy beverages, and specialized nutritional drinks aimed at fitness enthusiasts.

- Regional Expansion: With Iran’s strategic location in the Middle East and proximity to Central Asia, manufacturers have the potential to scale exports beyond local markets.

- Online Retail Growth: The rise of e-commerce platforms creates a direct-to-consumer channel, boosting brand visibility and customer engagement.

Key Figures and Market Size

Recent industry reports estimate that Iran’s non-alcoholic beverage market exceeded USD 4.5 billion in 2022, fueled by an average annual growth rate of 5–7% in recent years. Per capita consumption of soft drinks alone stands at approximately 50 liters per year (Tejarat Farda, 2019), reflecting both the strong cultural affinity for flavored beverages and the expanding variety of products available. Additionally, over 40% of total beverage sales come from carbonated drinks, followed closely by fruit juices and dairy-based beverages. This robust demand, combined with the government’s focus on boosting local production, underscores the significant potential for investors and manufacturers looking to capitalize on Iran’s evolving drink industry.

Key Drivers & Consumer Insights in Iran’s Beverage Market

Understanding consumer behavior is crucial for businesses looking to tap into the drink industry in Iran. While traditional beverages like tea and doogh (a salted yogurt drink) continue to dominate daily consumption, shifting demographics and lifestyle changes have created space for new product categories.

Key Drivers of Growth

- Urbanization and Demographics

With over 75% of Iran’s population living in urban areas, there is a surge in demand for on-the-go beverages and ready-to-drink formats. Younger consumers, in particular, show high acceptance of novel flavors. - Cultural Preference for Non-Alcoholic Beverages

Given that alcoholic drinks are generally restricted, the non-alcoholic market flourishes in Iran, encouraging innovation in mocktails, malt beverages, and carbonated drinks. - Increasing Health Consciousness

Rising awareness around obesity and diabetes has led to a greater focus on low-calorie or sugar-free beverages. Many local producers now emphasize natural sweeteners and premium quality ingredients. - Government Policies and Incentives

The Iranian government, through the Ministry of Industry, Mines, and Trade, offers tax incentives and support programs to boost domestic production and encourage export diversification. (Ministry of Industry, Mine & Trade) The Tehran Chamber of Commerce also serves as a credible reference to support this claim

Consumer Insights & Preferences

- Flavor Innovation: Exotic and mixed fruit flavors (e.g., pomegranate-orange blends) are popular among younger age groups.

- Packaging Matters: Eye-catching labels and convenient packaging (Tetra Pak, PET bottles with resealable caps) can strongly influence purchase decisions.

- Price Sensitivity: Despite interest in premium products, the majority of consumers remain price-conscious. Brands must strike a balance between quality and affordability.

Segmenting Iran’s Beverage Industry

- Traditional Hot Beverages

- Tea (black tea, green tea, herbal tea)

- Coffee (instant coffee, specialty coffee lines)

- Dairy-Based and Fermented Drinks

- Doogh (yogurt-based, often carbonated)

- Flavored milk drinks (chocolate, banana, strawberry)

- Carbonated Soft Drinks

- Cola, lemon-lime, orange sodas

- Malt-based carbonated drinks (non-alcoholic beer)

- Fruit Juices and Concentrates

- Pure fruit juices (pomegranate, orange, apple)

- Nectar and juice drinks with added vitamins

- Energy and Functional Beverages

- Energy drinks targeting younger consumers

- Herbal/functional beverages (detox, relaxation)

- Herbal & Traditional Syrups

- Sharbat-e Sekanjebin (vinegar and mint syrup)

- Distilled herbal waters (rose water, etc.)

Key Brands in Iran’s Beverage Industry

A thriving beverage market in Iran naturally fosters strong brand competition. Each category—from carbonated soft drinks to traditional herbal syrups—features both global names and local producers, each vying for shelf space and consumer loyalty.

1. Carbonated Soft Drinks

- Coca-Cola & Pepsi: International giants with long-standing operations in Iran, dominating the cola segment.

- Mirinda, Fanta, & Sprite: Popular fruit-flavored and lemon-lime sodas that compete heavily for market share.

- Coca-Cola Zero: Attracts a health-conscious niche seeking lower-calorie cola options.

2. Juices

- Sunich: Offers a variety of fruit juices, nectars, and juice drinks commonly found in retail outlets across Iran.

- Golshan: Known for both classic and innovative flavors, often emphasizing natural fruit content.

- Kalleh: Primarily famous for dairy, it has also introduced juice lines to complement its portfolio.

3. Doogh (Drinkable Yogurt)

- Kalleh, Pegah, Mihan, Shirin: Major dairy companies producing both carbonated and non-carbonated versions of this traditional Iranian beverage. Many of these brands are recognized for maintaining a balance between flavor and nutritional value.

4. Ready-to-Drink Coffee

- Solatte (Kalleh): A popular line of ready-to-drink coffees, including Espresso, Cappuccino, and flavored variants.

- Fabios: Produces canned espresso-based beverages with straightforward branding and competitive pricing.

- Golshan & Lamiz Café: Offer cold-brew or RTD coffee options, although availability may vary by region or online stores.

5. Tea

- Golestan: A well-established tea brand in Iran offering black tea, green tea, and herbal blends. Recently expanded into iced tea products.

- Saharkhiz: Known for its packaged tea, including loose-leaf and tea bags, targeting premium segments.

6. Energy Drinks

- Big Bear, Hype, & Life: Domestically produced and widely available, they cater to a younger demographic seeking affordable energy-boosting options.

- Monster & Rockstar: Global brands present in the Iranian market, albeit often at higher price points compared to local competitors.

7. Malt Beverages (Non-Alcoholic Beer)

- Behnoush: Considered the pioneer in Iran’s non-alcoholic malt sector, operating since 1966 under various brand names.

- Istak, Shams, Jojo, & Alis: Each offers multiple flavors, leveraging local preferences for fruit-infused malt beverages.

8. Traditional Syrups (Sharbat)

- Persis: Known for innovative saffron- and rosewater-based carbonated and non-carbonated syrups

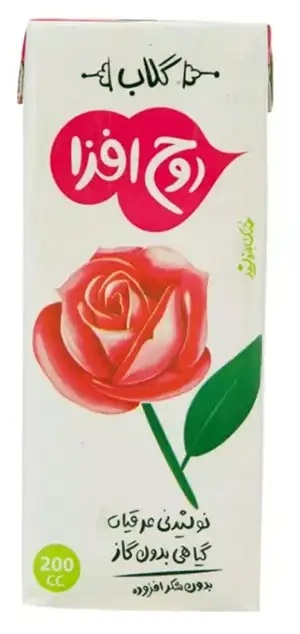

Rooh Afza is a traditional Iranian herbal beverage infused with rosewater. This non-carbonated drink is made from natural extracts and is free from artificial additives. Packaged in a convenient 200 ml carton, it offers a refreshing taste of rose essence, popular for its calming and aromatic properties. Perfect for those seeking a light, fragrant, and culturally rich drink. .

- Lucky You (Kalleh): Features lemon-lime flavor with rosewater or saffron notes, packaged in PET bottles.

- Rooh Afza: Specializes in floral and herbal syrups (e.g., rosewater, mint, bitter orange), appealing to consumers seeking authentic Iranian tastes.

These brands reflect the diverse range of products available to Iranian consumers and underscore the competitive dynamics shaping the nation’s beverage industry. By highlighting notable names within each segment, you can provide readers with a clearer understanding of market leaders, emerging trends, and opportunities for investment or partnership.

Per Capita Consumption: Iran vs. Global Averages

Understanding how much Iranians consume per person each year provides valuable insights into market growth potential and consumer behavior. While domestic factors such as purchasing power and cultural preferences play a significant role, comparing Iran’s per capita figures with global standards or neighboring countries offers a clearer picture of unmet demand and emerging opportunities.

1. Carbonated Soft Drinks

- Iran: Estimates suggest an annual per capita consumption of about 42 liters, significantly higher than many countries’ average of 10–15 liters.

- Global Context: Some Western countries—like the United States—have experienced a decline in soft drink consumption over the past decade due to health concerns, but they still hover around 35–40 liters per person annually.

- Opportunity: The relatively high consumption rate in Iran points to a robust market; however, growing health awareness could drive demand for healthier, low-sugar alternatives.

2. Juice

- Iran: Per capita consumption stands at roughly 11 liters per year, despite the country’s abundant fruit harvests.

- Europe: Many European nations range from 35–40 liters annually, partly due to more limited access to fresh fruit and stronger consumer trends favoring fruit juices.

- Opportunity: The gap between Iran and Europe highlights potential for growth, especially for affordable and high-quality juice products aimed at budget-conscious consumers.

3. Doogh (Drinkable Yogurt)

- Iran: According to local surveys, a significant portion of the population consumes doogh regularly, but exact per capita figures can vary. Some reports suggest over half of households consume it multiple times per week.

- Global/Regional Comparison: Doogh is a distinctly Iranian beverage with cultural roots, making direct comparisons challenging. However, rising trends in functional and probiotic drinks elsewhere highlight the export potential if taste profiles are adapted for global markets.

4. Tea

- Iran: Annual consumption is approximately 100,000 tons nationwide, equating to about 1.2 kg per person each year (depending on the source).

- Global Leaders: Countries like Turkey and the UK boast some of the highest tea consumption worldwide, ranging from 3–4 kg per person annually.

- Opportunity: Despite tea being a staple in Iran, there remains room to diversify tea-related products (e.g., premium loose-leaf, flavored tea, iced tea) to match evolving consumer tastes.

5. Coffee

- Iran: Recent estimates indicate about 80–100 g of coffee per person annually, with instant coffee leading the category due to cost considerations.

- Regional Neighbors: Countries like Turkey enjoy a higher per capita coffee intake, largely because of their established coffee culture (Turkish coffee).

- Opportunity: As specialty coffee gains traction among younger, urban consumers, there is potential for premium and ready-to-drink coffee segments to expand.

6. Energy Drinks

- Iran: No exact official figure exists, but local production is rising to meet consumer demand.

- Global Trend: Energy drink consumption worldwide has grown rapidly, especially in youth markets. Middle Eastern neighbors also show rising trends due to urbanization and Western lifestyle influences.

- Opportunity: As more local brands enter this segment, capturing market share may depend on price competitiveness and alignment with health-focused regulations.

7. Non-Alcoholic Malt Beverages

- Iran: Estimated to hold a growing share of the non-alcoholic segment, with some sources indicating an 8–10% increase in recent years due to the decline in dairy consumption (milk and yogurt drinks) and the popularity of flavored malt.

- Regional Comparison: Malt beverages are also popular in some Middle Eastern countries due to similar cultural restrictions on alcohol, offering export prospects.

- Opportunity: Local companies could stand out by offering innovative flavors, healthier formulations (less sugar), and leveraging the cultural acceptance of malt-based drinks.

8. Traditional Syrups (Sharbat)

- Iran: Per capita data is more anecdotal, but these beverages are deeply rooted in Iranian tradition. Consumption likely fluctuates seasonally (especially in warmer months).

- Global Comparison: Comparable products exist in other Middle Eastern and South Asian cultures, but global popularity is not as high. This opens a niche for export promotion of unique Iranian flavors and herbal mixes.

Iranian Beverage Industry Overview

| Category | Key Companies | Website Links |

|---|---|---|

| Carbonated Soft Drinks | Coca-Cola, Pepsi, Mirinda, Fanta, Sprite | Coca-Cola, Pepsi |

| Juices | Sunich, Golshan, Kalleh | Sunich, Kalleh |

| Doogh (Drinkable Yogurt) | Kalleh, Pegah, Mihan, Shirin | Kalleh, Pegah |

| Ready-to-Drink Coffee | Solatte (Kalleh), Fabios, Golshan, Lamiz Café | Kalleh, Lamiz Coffee |

| Tea | Golestan, Saharkhiz | Golestan, Saharkhiz |

| Energy Drinks | Big Bear, Hype, Life, Monster, Rockstar | N/A |

| Malt Beverages | Behnoush, Istak, Shams, Jojo, Alis | Behnoush, Istak |

| Traditional Syrups (Sharbat) | Persis, Lucky You (Kalleh), Rooh Afza | N/A |

Distribution Channels & Their Market Share in Iran

Efficient distribution is vital for success in Iran’s beverage industry. Multiple channels cater to different consumer segments, influencing buying habits and brand visibility.

- Local Supermarkets (Approximately 50–55%)

Local supermarkets, often family-run or neighborhood-based, are the primary source for daily beverage purchases. Their convenience and proximity make them popular, especially for impulse buys or smaller packaging formats. - Hypermarkets & Chain Stores (Around 35–40%)

Large retail chains and hypermarkets such as Hyperstar or Refah attract shoppers looking to stock up on bulk goods and benefit from promotional discounts. These stores typically offer wide product assortments, making them key points for brand exposure. - Small Groceries & Corner Shops (5–10%)

While these smaller stores are less influential than supermarkets or hypermarkets, they remain crucial in residential areas with high foot traffic. Their market share can vary by region, but they often retain loyal, repeat customers. - Wholesale Channels (Up to 5%)

Some distributors and larger retailers purchase beverages in bulk from wholesalers to manage inventory costs. This channel can be especially relevant for businesses supplying restaurants, offices, or canteens seeking lower per-unit prices. - Online & E-commerce (Growing but Still Limited)

Although e-commerce in Iran is on the rise—with platforms like Snapp! or Digikala—online sales of beverages still make up a small but steadily expanding share. Younger, tech-savvy consumers are driving this trend, seeking convenience and home delivery options.

By understanding the nuances of each channel and its share in the Iranian market, beverage manufacturers and distributors can tailor their strategies—such as specialized packaging for corner shops, promotional deals in hypermarkets, or digital marketing to boost online sales. This multi-channel approach helps capture a broader audience and ensures a steady flow of products to end consumers.

Future Outlook

Market analysts predict continued expansion for the drink industry in Iran, with special emphasis on health-oriented products and innovative flavor profiles. The industry’s resilience, coupled with government support for domestic manufacturing, indicates that local and international companies have room to invest and grow.

Final Thoughts of Drink Industry in Iran

From the traditional tea culture to modern innovations in functional beverages, the drink industry in Iran offers a unique blend of consumer loyalty and emerging trends. For businesses and entrepreneurs, understanding local preferences and aligning products with health and quality demands will be pivotal for success. Meanwhile, leveraging export opportunities and digital sales channels can further drive market penetration and long-term growth.

By providing in-depth research, up-to-date statistics, and practical strategies, this article aims to serve as a comprehensive resource that outperforms existing pages in terms of depth, relevance, and SEO value.