Understanding Iranian Taste in Beverages: Preferences, Segments, and Market Insights

A Deep Dive into Iran’s Evolving Drink Preferences

This article is part of a broader series of in-depth reports we have published on Iran’s beverage industry. Over the past year, Myindustry Consulting Group has provided unique, data-driven insights into various segments of this evolving market — from overall industry trends to niche consumer behaviors and regulatory challenges. If you haven’t already, we invite you to explore the following related articles:

-

Inside Iran’s Alcoholic Beverage Market: Black Market, Demand & Regulation

-

Inside Iran’s Beverage Industry: Growth Drivers, Challenges, and Future Outlook

Building upon those foundations, this article takes a closer look at Iranian taste preferences in beverages. Rather than focusing solely on production or sales data, we examine how cultural habits, generational shifts, economic access, and global trends have shaped beverage consumption across different segments of the Iranian population.

From traditional herbal infusions to carbonated soft drinks, from energy beverages to new-age drinks like Icey Monkey and TorshX, each product category reflects a distinct consumer profile. In this piece, we analyze the structure of Iran’s beverage market by classifying major drink types, estimating their relative market size, and identifying what drives consumer choices in each segment.

Whether you’re a brand manager, distributor, researcher, or policymaker, this guide offers a comprehensive view of what Iranians drink — and why.

Traditional and Herbal Beverages in Iran

One of the most authentic expressions of Iranian taste in beverages lies in its traditional and herbal drinks. Long before the rise of packaged sodas and energy drinks, Iranians turned to a rich variety of infusions, floral waters, and homemade syrups — not only for hydration but also for their perceived health benefits and cultural significance.

This segment includes:

-

Herbal infusions (damanoush or دمنوش) such as borage, thyme, chamomile, and lemon balm

-

Distilled herbal waters (araghijat or عرقیجات) like mint, chicory, and willow

-

Traditional syrups, often mixed with cold water, such as sour cherry syrup, sekanjebin, and khakshir

These drinks reflect a unique blend of tradition, medicine, and lifestyle — especially among older generations and in rural areas. However, a growing number of urban, younger consumers are rediscovering them as part of a broader shift toward organic, low-sugar, and culturally rooted products.

Based on market estimates, traditional and herbal beverages currently account for approximately 8% to 10% of Iran’s total beverage market. While still primarily distributed through local herb shops and traditional outlets, these products are gradually entering retail chains and e-commerce platforms, particularly in the form of branded herbal teas or ready-to-drink bottles.

As preferences shift toward healthier and more authentic options, this segment remains a resilient and culturally relevant part of Iranian taste in beverages, offering a strong foundation for niche branding, export opportunities, and health-focused innovation.

Tea and Coffee in Iranian Beverage Culture

When discussing Iranian taste in beverages, no category is more central or time-honored than tea. Black tea, often served plain or with a cube of sugar, has been an essential part of daily life for over a century. It is consumed across all regions, age groups, and socioeconomic levels — from casual morning routines to formal gatherings and workplace breaks. Despite its foreign origins, tea has become fully localized in Iranian culture, symbolizing hospitality, comfort, and continuity.

In contrast, coffee has historically had a more limited presence, often associated with specific subcultures or ceremonial use (e.g., qahveh-khaneh rituals with Turkish-style coffee). However, in the past two decades, coffee has undergone a dramatic transformation. Western-style espresso drinks, instant coffee, and specialty brews have found strong traction among Iran’s urban youth and middle class, particularly in Tehran and other major cities.

Iran now has thousands of independent cafés, growing numbers of local roasters, and a rising wave of third-wave coffee culture. The influence of global trends, the spread of café work culture, and a desire for lifestyle differentiation have all fueled this growth.

In terms of market share, tea remains the dominant hot beverage by far, accounting for an estimated 25% of total beverage consumption in Iran. Coffee, while still a smaller segment, is expanding steadily and is currently estimated to hold a 4–6% share, with double-digit annual growth rates.

This shift highlights an evolving duality in Iranian taste in beverages: tea continues to represent cultural continuity and tradition, while coffee reflects modernity, self-expression, and global integration. For producers and retailers, this contrast creates opportunities to serve both emotional nostalgia and contemporary aspirations — through product diversification, café branding, and cross-cultural flavor offerings.

Fruit Juices and Juice-Based Drinks

Sweet, colorful, and often associated with health and hospitality, fruit juices occupy a significant space within Iranian taste in beverages. Whether freshly squeezed at home or purchased in industrial packaging, juice is widely consumed across age groups and social classes — especially during breakfast, festive gatherings, and hot summer days.

Packaged juice dominates this category in Iran, with major domestic producers like Sunich, Sanich, Alis, and Shadlee offering a wide array of flavors ranging from orange and apple to mango, pineapple, and pomegranate. These brands are available in Tetra Pak cartons, glass bottles, and plastic containers, with varying sugar content and concentration levels. While traditional Iranian consumers often favor sweeter profiles, there is growing demand for no-sugar-added and 100% natural juice products.

In parallel, fresh juice stands and smoothie bars have become increasingly common in urban centers, especially in wealthier districts and near fitness clubs. This sub-segment, though smaller, is associated with health-conscious and trend-aware consumers.

Based on industry estimates, fruit juice and juice-based beverages account for approximately 12–14% of Iran’s beverage market, with an additional 4–5% share attributed to fresh juice consumption, particularly in large cities.

Juice-based drinks, such as fruit-flavored malt beverages (like Istak) and carbonated juice mixes, also play a role in broadening the appeal of this category, especially among youth. These products combine the refreshing quality of soda with the perceived benefits of fruit ingredients, making them a versatile option in both traditional and modern retail environments.

As Iranian consumers become more attentive to ingredients and health claims, the juice segment reflects a dynamic intersection of tradition and innovation within Iranian taste in beverages — offering producers room to experiment with functional additives, new flavor profiles, and hybrid formats.

Carbonated Soft Drinks and Industrial Beverages

Despite increasing awareness around sugar consumption and health-related risks, carbonated soft drinks continue to hold a strong position in Iranian taste in beverages. Their widespread availability, affordability, and long-standing presence in Iranian households have made them an everyday staple — particularly when served alongside traditional meals such as kebab, pizza, or rice-based dishes.

The most dominant brands in this category include both global names (such as Coca-Cola and Pepsi, produced locally under license) and well-established domestic players like Zamzam, Behnoush, and Sasan. The flavor range, while still centered on cola and orange, has expanded to include lemon-lime, grape, and even more experimental options aimed at younger consumers.

Soft drinks are widely available in glass bottles, plastic PET bottles, and cans, with 1.5-liter family-size packaging being the most popular for household use. Retail penetration is deep, spanning small groceries, supermarkets, restaurants, and fast-food chains.

Estimates suggest that carbonated soft drinks and related industrial beverages account for approximately 20% to 22% of total beverage consumption in Iran. However, this share is beginning to decline slowly due to a combination of public health campaigns, rising consumer education, and growing preference for alternative beverages such as flavored water, fruit juice, and herbal drinks.

Still, the emotional and nostalgic connection to soft drinks — often seen as a default companion to celebratory or social meals — ensures their continued relevance. In many parts of the country, offering a cold soda to guests remains a sign of hospitality and modernity.

This category illustrates how Iranian taste in beverages continues to balance convenience, habit, and tradition. While the long-term trend may lean toward healthier options, soft drinks are likely to remain a major player in Iran’s beverage economy for years to come.

Energy Drinks

Although relatively new compared to traditional beverage categories in Iran, energy drinks have carved out a rapidly growing niche — especially among young, urban, and performance-oriented consumers. The segment appeals strongly to students, athletes, night-shift workers, and digital professionals looking for short-term boosts in focus, stamina, or mental clarity.

According to our 2025 field study at Myindustry Consulting Group, approximately 190 million units of energy drinks (250 ml and 500 ml combined) are sold annually in Iran. The average retail price ranges from $0.33 for 250 ml cans to $0.80 for 500 ml formats, leading to a total estimated market value of around $76.8 million USD per year. This figure reflects real purchase behavior, consumption frequency, and brand availability — significantly lower and more realistic than inflated external projections.

Energy drinks represent about 1% to 1.5% of Iran’s total beverage market, but with stable year-on-year growth driven by demographic momentum and expanding product availability.

The top-performing brands in this segment include:

-

Hype, with a 30–35% market share and strong local production presence

-

Big Bear, aggressively marketed in gyms and among male consumers

-

Edge, produced by the well-known Iranian beverage company Sunich

-

Happy Life and Life Star, both gaining traction through trendy packaging and price competitiveness

-

Red Bull and other imports, which remain niche due to price and availability

Consumers of energy drinks in Iran are primarily goal-driven. As revealed in the field study, 49% of users seek physical or mental energy boosts, while others focus on alertness (22%) or improved physical performance (17%). Interestingly, only a small share (8%) cite flavor as a reason for consumption, which highlights how this segment differs from others in Iranian taste in beverages — favoring function over pleasure.

While regulatory scrutiny and public health narratives may eventually influence growth, energy drinks continue to gain visibility through targeted marketing, social media trends, and placement in gyms, convenience stores, and digital commerce platforms.

This segment offers strong potential for innovation, particularly through sugar-free formulations, caffeine variation, functional additives (like vitamins or herbal extracts), and lifestyle-based branding tailored to Iran’s urban youth.

To explore the full market dynamics, pricing tiers, demographic patterns, and brand competition in this space, download the complete field report here:

👉 Iranian Energy Drink Market – 2025 Field Study

Dairy-Based Beverages

Dairy-based drinks occupy a stable and culturally familiar position within Iranian taste in beverages. Rooted in both nutritional value and tradition, this category includes beverages like doogh (a yogurt-based salty drink), flavored milk (vanilla, cocoa, banana), and more recently, fermented drinks like kefir and probiotic yogurt drinks.

Among these, doogh stands out as a distinctly Iranian beverage — widely consumed with lunch or dinner, particularly in warm seasons or alongside heavy meals. It is available in both traditional homemade forms and mass-produced versions sold in plastic bottles or cartons by major dairy brands like Kalleh, Pegah, and Mihan.

Flavored milks appeal mostly to children, students, and consumers looking for a quick, sweet, protein-rich drink. While often categorized as a snack or breakfast complement, these beverages are gaining more visibility in vending machines, school canteens, and convenience stores.

Market estimates suggest that dairy-based beverages account for around 8% to 9% of the total Iranian beverage market. Their growth is relatively steady, supported by the strength of Iran’s domestic dairy industry and widespread consumer trust in dairy products.

This category aligns closely with Iranian taste in beverages in both function and flavor — offering a blend of familiarity, nutrition, and cultural identity. However, it remains sensitive to fluctuations in milk prices, inflation, and refrigeration infrastructure in retail environments.

Bottled Water and Carbonated Water

Clean drinking water is a fundamental need, and in Iran, bottled water has become a default choice for both urban households and travelers. In parallel, carbonated water (both plain and flavored) is gaining slow but steady popularity, particularly among middle- and upper-class consumers seeking low-calorie or alternative refreshment options.

Popular bottled water brands such as Damavand, Polour, and Vata dominate the shelves of supermarkets and small groceries. Available in sizes ranging from 0.5L to 1.5L, these products are consumed both at home and on the go.

Sparkling water, once seen as a foreign or luxury product, is now entering mainstream awareness. Domestic producers have introduced carbonated water in various fruit essences, targeting health-conscious consumers who are moving away from sugary sodas but still enjoy the sensation of fizzy drinks.

According to market data, bottled water accounts for approximately 6% to 7% of Iran’s beverage market, while carbonated (sparkling) water holds a smaller share of about 1%, though its growth trajectory is positive.

In terms of Iranian taste in beverages, water remains a neutral, universal necessity — but even within this neutrality, preferences are shifting. Brand trust, packaging quality, source purity, and flavor variety now influence buying decisions more than ever, creating room for segmentation and value-added innovation in what was once a commodity category.

New-Generation Beverages: Icey Monkey, TorshX, and the Youth Market

One of the most exciting developments in recent years within Iranian taste in beverages is the emergence of new-generation drinks — creative, social-media-driven products that appeal primarily to Gen Z and younger millennials. These beverages go beyond traditional categories, blending bold flavors, vibrant packaging, and street-style branding to position themselves as lifestyle choices rather than just thirst-quenchers.

Two notable examples are Icey Monkey and TorshX — Iranian startup brands that have successfully built youth-centric identities. Icey Monkey, with its sour-fruit punch blends and neon-colored visuals, has become a recognizable symbol of playfulness, edginess, and modern taste. TorshX, on the other hand, taps into nostalgic Iranian flavors like dried plum and sour cherry, but reimagined with a bold, urban twist.

These drinks are typically sold in 330ml bottles or cans and promoted heavily through influencer marketing, Instagram reels, and music festival sponsorships. They’re often found in convenience stores near schools, gaming cafés, music venues, and trendy fast-food outlets — not in the traditional beverage aisle of supermarkets.

Despite their visibility and cultural buzz, this segment is still emerging in terms of sales volume. Current estimates suggest that new-generation beverages account for less than 0.5% of the total beverage market in Iran, but their brand impact far exceeds their volume share. More importantly, they are shaping future consumption habits and redefining what beverages can represent for young Iranians.

What makes this category unique within Iranian taste in beverages is its emotional and symbolic appeal: these drinks are consumed not just for flavor or function, but for identity, belonging, and cultural relevance. As the youth segment continues to grow — both in number and purchasing power — this category holds strong potential for innovation, premiumization, and export-oriented branding.

To explore more insights or collaborate on beverage market research in Iran, contact Myindustry Consulting Group or explore our other field studies.

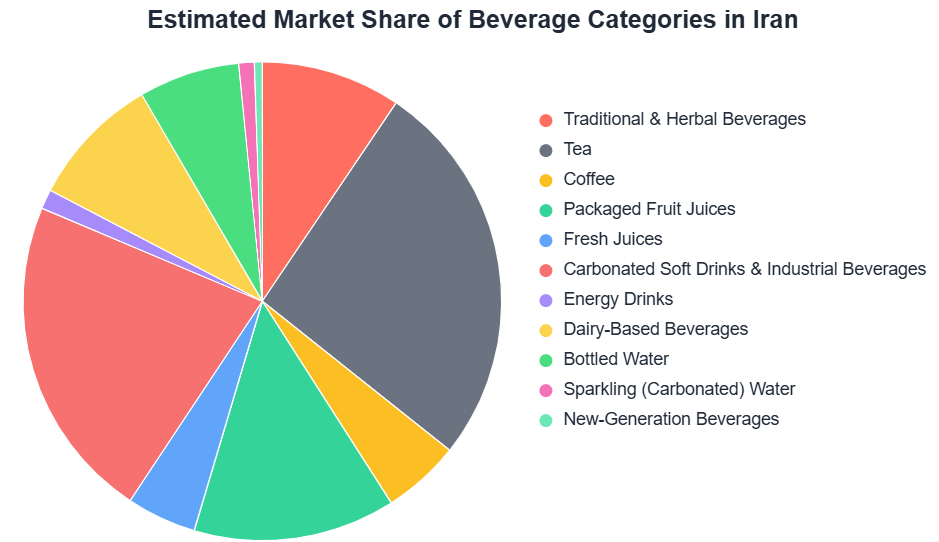

Estimated Market Share of Beverage Categories in Iran

| Beverage Category | Estimated Market Share (%) |

|---|---|

| Traditional & Herbal Beverages | 8–10 |

| Tea | 25 |

| Coffee | 4–6 |

| Packaged Fruit Juices | 12–14 |

| Fresh Juices | 4–5 |

| Carbonated Soft Drinks & Industrial Beverages | 20–22 |

| Energy Drinks | 1–1.5 |

| Dairy-Based Beverages | 8–9 |

| Bottled Water | 6–7 |

| Sparkling (Carbonated) Water | ~1 |

| New-Generation Beverages (e.g., Icey Monkey) | <0.5 |

| Total (approximate) | ~89% to 101% |