Inside Iran’s Alcoholic Beverage Market: Black Market, Demand & Regulation

A deep look into Iran’s hidden alcohol economy

As part of our ongoing research into Iran’s beverage landscape, Myindustry Consulting Group has previously provided comprehensive insights into the country’s broader drink industry. From a full analysis of the beverage market in Iran to a pricing overview of popular drinks, and a deep dive into market drivers, challenges, and future outlook, our coverage has helped readers and analysts navigate this complex sector. In this article, we shift focus to one of the most controversial and less openly discussed segments: the alcoholic beverage market in Iran—its hidden demand, black-market mechanics, and legal dynamics. (Iran’s Alcoholic Beverage Market)

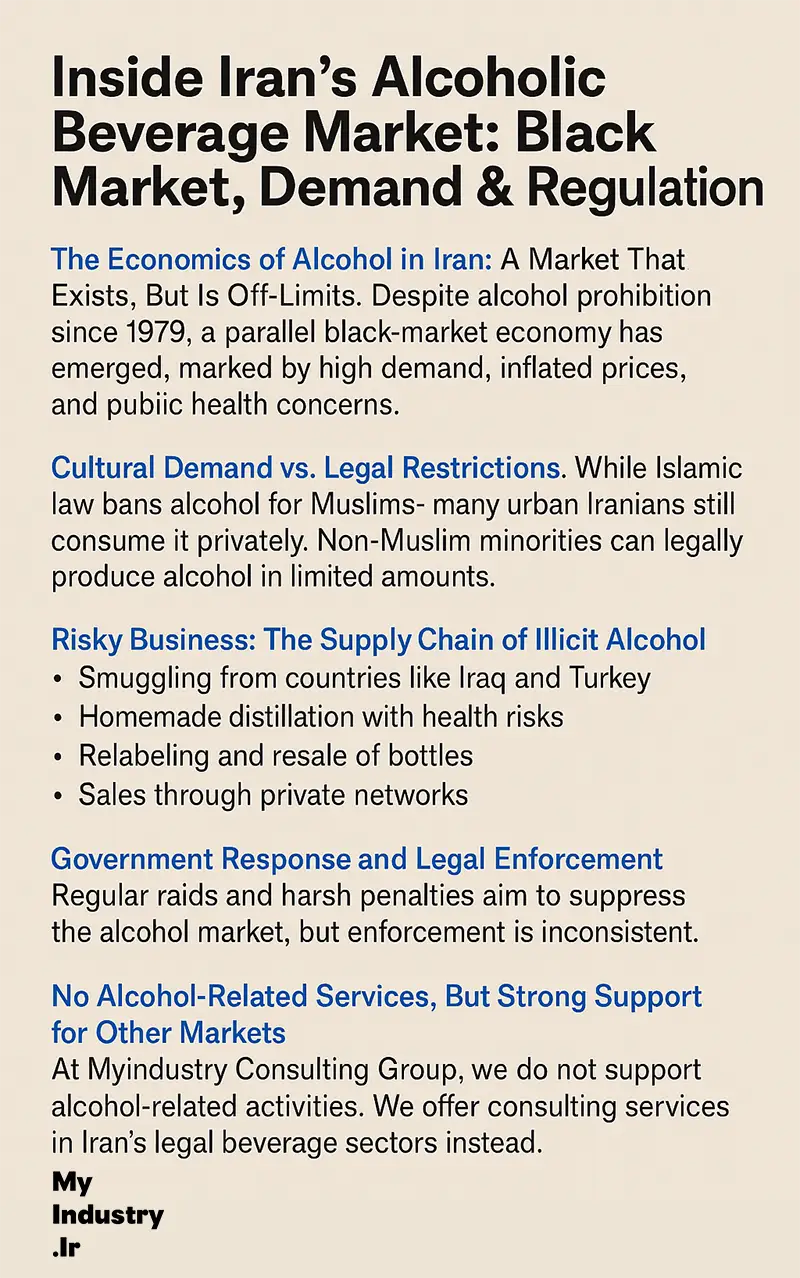

The Economics of Alcohol in Iran: A Market That Exists, But Is Off-Limits

Despite the nationwide prohibition on alcohol production, distribution, and consumption in Iran since 1979, the demand for alcoholic beverages has never completely disappeared. On the contrary, black-market activity has sustained a parallel and largely invisible economy—one that operates outside the formal legal framework, yet responds to real consumer behavior.

Estimates vary, but several independent reports suggest that millions of liters of alcohol are consumed annually in Iran, either through illicit imports, underground home production (commonly known as “arak”), or smuggled branded bottles. This activity not only represents a significant untaxed flow of capital, but also raises public health and safety concerns due to poor-quality and sometimes toxic homemade drinks.

From an economic standpoint, the alcoholic beverage market in Iran illustrates a high-demand/high-risk model. Prices are inflated due to scarcity and illegality, with luxury foreign brands sometimes being sold at ten times their original value. There’s also a complex network of smuggling routes, local bottling practices, and informal distribution channels—none of which are accessible to legitimate businesses or investors.

Cultural Demand vs. Legal Restrictions

Understanding Iran’s alcohol market requires acknowledging a cultural duality. While Islamic law prohibits alcohol consumption for Muslims, a significant number of Iranians, particularly in urban centers and among younger demographics, maintain private drinking habits. This demand is partly cultural and partly symbolic, associated with a sense of modernity, rebellion, or Western lifestyle.

In contrast, non-Muslim minorities such as Armenian and Assyrian Christians are legally allowed to produce and consume alcohol for religious purposes. However, their production volumes are limited, and their products rarely make it to the wider black market.

This legal contradiction underscores the complexity of the market: a substance simultaneously banned, consumed, and in some rare cases, legally produced—creating blurry lines between criminality and culture.

Risky Business: The Supply Chain of Illicit Alcohol

The supply chain behind Iran’s black-market alcohol is risky, diverse, and decentralized. Some of the main channels include:

- Smuggling from neighboring countries, especially Iraq, Turkey, and the UAE

- Homemade distillation, often with limited quality control and high health risks

- Relabeling and recycling of empty branded bottles for resale

- Sale through private Telegram channels, WhatsApp groups, and trusted personal networks

This underground economy lacks standardization, regulation, and safety oversight. Alcohol poisoning incidents periodically make headlines in local media, often with tragic outcomes. In recent years, there have been several documented cases of blindness and death from methanol-laced alcohol.

Price and Purchasing Behavior

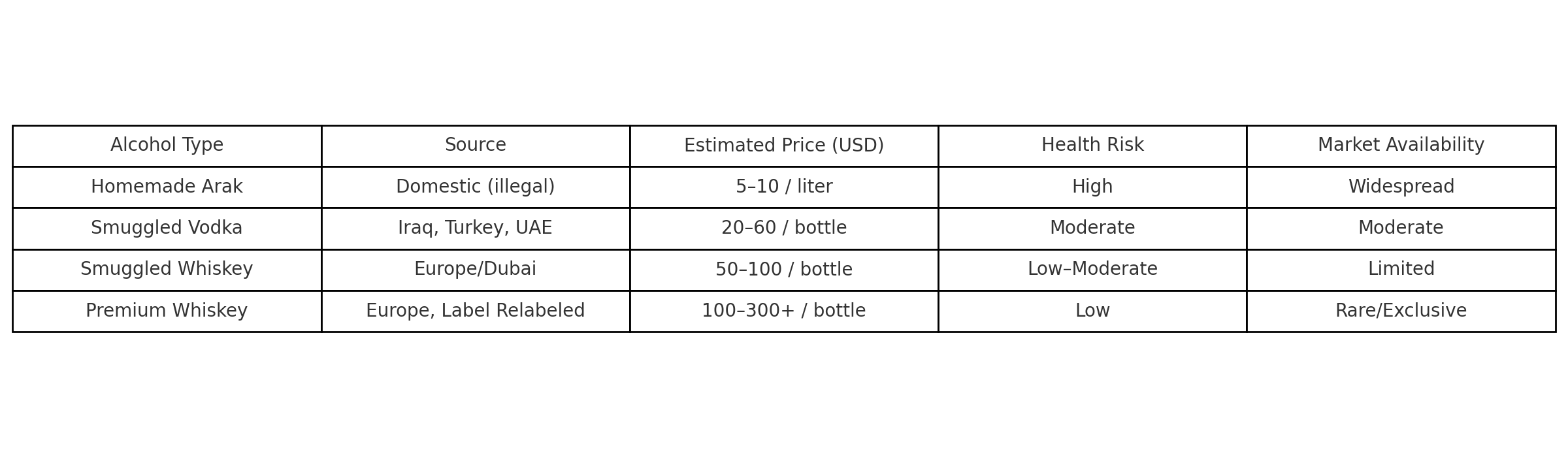

Prices for alcoholic beverages in Iran vary widely depending on origin, type, and method of acquisition. Some rough estimates:

- Locally made homemade alcohol (arak): $5–$10 per liter

- Smuggled mid-tier vodka or whiskey: $20–$60 per bottle

- Premium brands (e.g. Johnnie Walker): $100–$300+ per bottle

Purchases are typically made through informal networks. Trust plays a major role, as buyers prefer to deal with known contacts to reduce the risk of counterfeit or toxic products. Payments are usually in cash or through indirect methods (e.g. gift card exchanges) to avoid banking scrutiny.

Government Response and Legal Enforcement

Iranian authorities periodically crack down on the black-market alcohol trade. Raids, arrests, and public destruction of seized bottles are common. However, the persistence of demand and the ingenuity of underground networks make full eradication unlikely.

Punishments for alcohol-related offenses vary. Consumption can lead to fines, flogging, or imprisonment, while production and distribution carry heavier sentences. Yet enforcement is inconsistent, and many first-time offenders receive more lenient treatment, particularly in urban areas.

Our Position: No Alcohol-Related Services, but Strong Support for Other Markets

At Myindustry Consulting Group (MCG), we are committed to working strictly within legal and regulatory boundaries. While we recognize the existence of this underground market and its impact on consumer behavior and macroeconomic dynamics, we do not offer any services, consultations, or market support related to alcoholic beverages.

However, for investors, entrepreneurs, and companies looking to enter or expand within Iran’s legal beverage sectors—including bottled water, soft drinks, fruit juices, energy drinks, or dairy-based beverages—we offer in-depth industry reports, competitor analysis, pricing intelligence, and strategy consulting. With our local expertise and data-driven approach, we help you unlock growth opportunities in one of the Middle East’s most resilient consumer markets.

📩 To explore how we can support your entry or expansion into Iran’s legal beverage markets, feel free to contact us.

Final Thoughts

The alcoholic beverage market in Iran is a paradox: illegal yet active, hidden yet impactful, dangerous yet profitable. For analysts, economists, and cultural observers, it offers a fascinating case study of demand under restriction. But for legitimate businesses, it remains off-limits—a reminder that not all markets are open, and not all profits are worth the risk.

At MCG, we invite you to explore Iran’s growing legal drink economy instead—where opportunities abound, and where innovation and integrity can thrive together. (Read More)