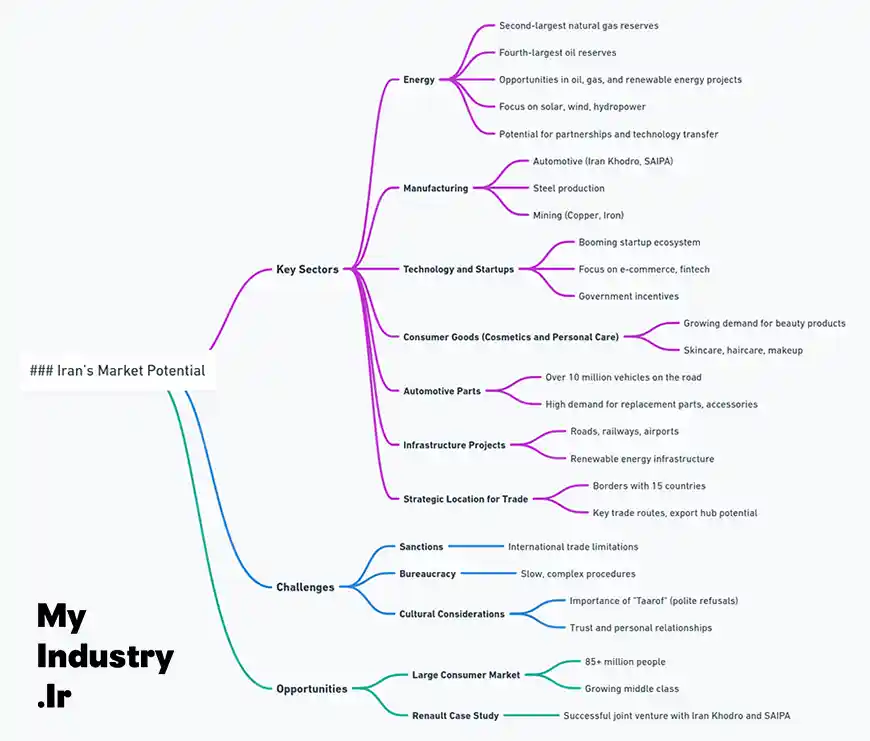

Iran is a country with a rich history, abundant resources, and a diverse economy, offering attractive opportunities for global investors. This article will guide you through the key sectors, challenges, and strategies to help you tap into Iran’s market potential. We’ll break down complex information into clear, digestible insights that make it easier for you to navigate Iran’s business landscape.

Why Iran’s Market Potential Matters

When considering Iran as an investment destination, the first thing to note is its vast natural wealth. With the world’s second-largest natural gas reserves and fourth-largest oil reserves, Iran (ایران) is a significant player in the global energy market. But it doesn’t stop there. Iran has a growing population of over 85 million people, many of whom belong to a burgeoning middle class eager for new consumer products and services. This blend of natural resources and consumer demand positions Iran as a prime location for international investment.

Sectors Driving Iran’s Market Potential

Understanding which sectors are thriving in Iran is key to making informed investment decisions. Here are some of the top industries:

1. Energy Sector

The energy sector is the backbone of Iran’s economy, with the country holding the world’s second-largest natural gas reserves and fourth-largest oil reserves. Iran’s oil industry continues to be a significant player in global energy markets, despite international sanctions. In addition to oil, Iran’s natural gas sector provides massive opportunities for foreign investors, particularly in upstream and downstream activities such as exploration, production, refining, and petrochemicals.

The government is also shifting focus towards renewable energy, aiming to diversify its energy sources. Solar, wind, and hydropower projects are being developed to reduce reliance on fossil fuels. Iran has set ambitious targets for renewable energy, providing incentives for foreign companies to invest in this growing sector. These projects, along with infrastructure improvements, make Iran a key player in the region’s energy transition.

Moreover, as global demand for cleaner energy solutions grows, Iran’s investment in renewable technologies opens the door for partnerships and technology transfer from international companies with expertise in green energy. The renewable energy sector is relatively untapped in Iran, offering early-mover advantages for foreign firms.

Iran’s energy policies are also shifting to encourage foreign investment, particularly in joint ventures and technological collaboration. The country’s vast energy infrastructure, including refineries, pipelines, and LNG facilities, presents considerable opportunities for development and modernization by foreign companies. With its rich natural resources, strategic location, and a growing push towards energy diversification, Iran remains a highly attractive market for international investors in the energy sector.

2. Manufacturing

2. Manufacturing

Iran’s manufacturing sector includes significant industries such as automotive and textiles. Iran Khodro (ایران خودرو) and SAIPA (سایپا) are leading car manufacturers in the region, and partnerships with these companies provide access to a large market with relatively low labor costs. Other sectors like steel production and mining (especially copper and iron) offer even more avenues for investment.

3. Technology and Startups

Iran’s tech scene is booming. Young entrepreneurs are driving innovation, particularly in areas like e-commerce and fintech. Iran’s government has also been supportive of technology companies, offering various incentives for businesses investing in tech infrastructure. This is a sector where global investors can help accelerate Iran’s progress by offering both capital and technological expertise.

Challenges to Unlocking Iran’s Market Potential

No investment opportunity is without its challenges, and Iran is no exception. Understanding these obstacles is crucial for any business looking to succeed in this market.

1. Sanctions

One of the biggest challenges facing Iran is the international sanctions that limit its trade and economic activities. While these sanctions are complex, they don’t make investing in Iran impossible. Companies willing to comply with international laws and sanctions regulations can still navigate this market successfully.

2. Bureaucracy

Iran’s bureaucratic procedures can be slow and complicated. Whether you’re trying to register a business or acquire necessary licenses, expect some red tape. However, working with local partners who understand the ins and outs of the system can help speed things up.

3. Cultural Considerations

Iranian business culture is unique. One notable aspect is “Taarof” (تعارف), a custom involving polite refusals and offers. For foreign investors, understanding this tradition can be a critical factor in establishing strong, respectful business relationships. Building trust and engaging in personal, face-to-face meetings will go a long way in the Iranian market.

Opportunities for Foreign Investors

Despite these challenges, Iran offers significant rewards for those who can navigate its complexities.

1. Large Consumer Market

Iran’s population of over 85 million people makes it one of the largest consumer markets in the Middle East. With a growing middle class, there is increasing demand for consumer goods, from food products to luxury items. International businesses that can meet these demands will find a welcoming market.

In Iran, the cosmetics and personal care market is booming, driven by a large, youthful population with a strong interest in beauty products. Iran ranks among the top consumers of cosmetics in the Middle East, with rising demand for skincare, haircare, and makeup products, offering substantial growth potential for international brands.

Additionally, Iran’s automotive sector has a robust demand for car parts, with over 10 million vehicles on the road. The need for replacement parts and accessories creates a lucrative market for foreign investors in the automotive supply chain.

2. Infrastructure Projects

Iran is focusing on upgrading its infrastructure, particularly in transportation and energy. With major projects underway to improve roads, railways, and airports, there’s ample opportunity for foreign investors to contribute to these developments. Iran’s push for renewable energy sources like wind and solar also opens doors for investors in the green energy sector.

3. Strategic Location

Iran’s geographical position makes it a prime gateway for trade between Europe, Asia, and the Middle East. Companies looking to expand their presence across multiple regions can use Iran as a hub, taking advantage of its strategic location and extensive transportation networks.

Making the Most of Iran’s Market Potential

Unlocking Iran’s market potential requires a clear understanding of its strengths, challenges, and opportunities. The country’s vast natural resources, large consumer base, and strategic location make it an attractive destination for international investors. However, success in this market depends on thorough research, compliance with international regulations, and an appreciation for local culture.

For more information on investment opportunities in Iran, visit the official Iranian Ministry of Industry, Mine, and Trade website.